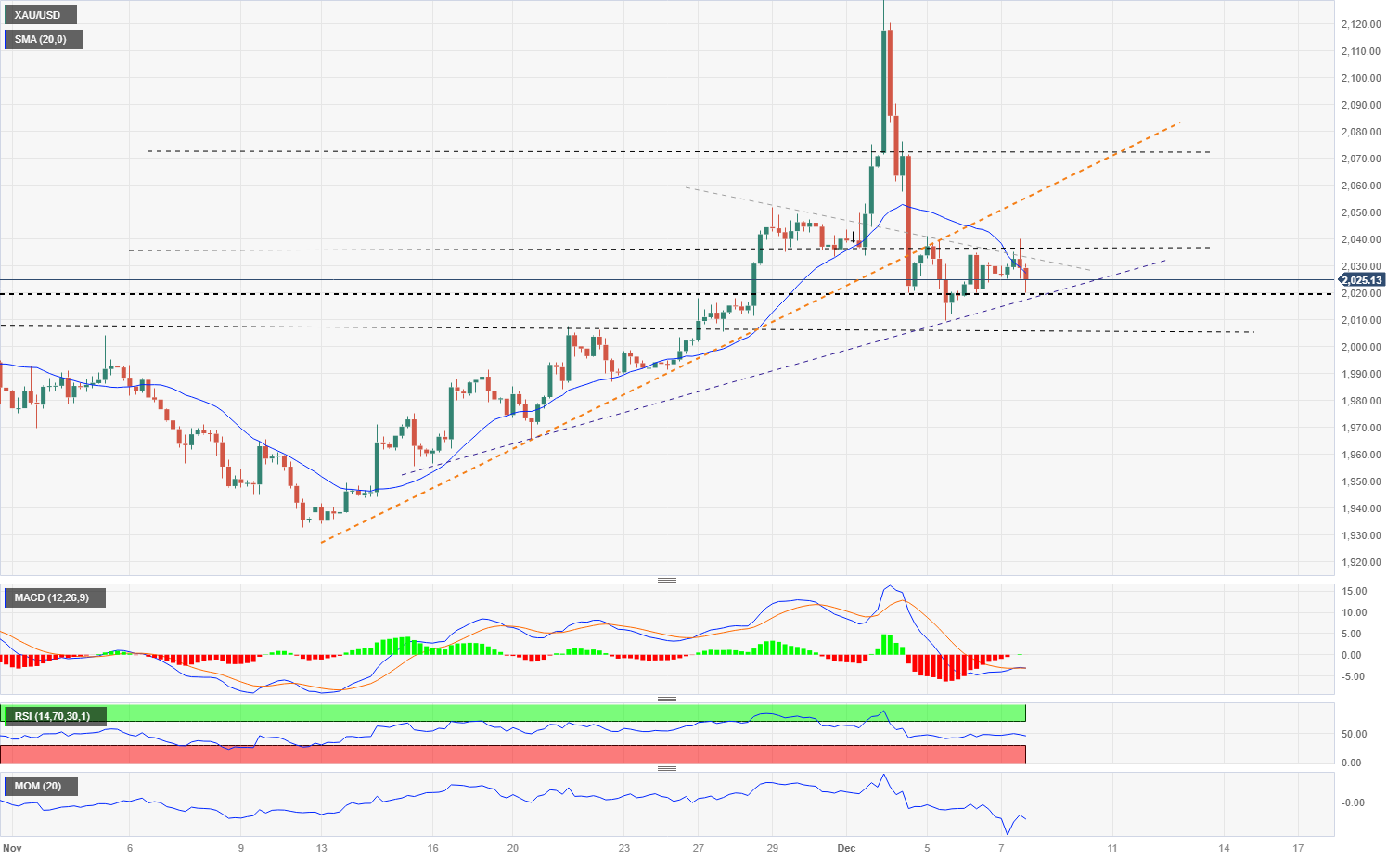

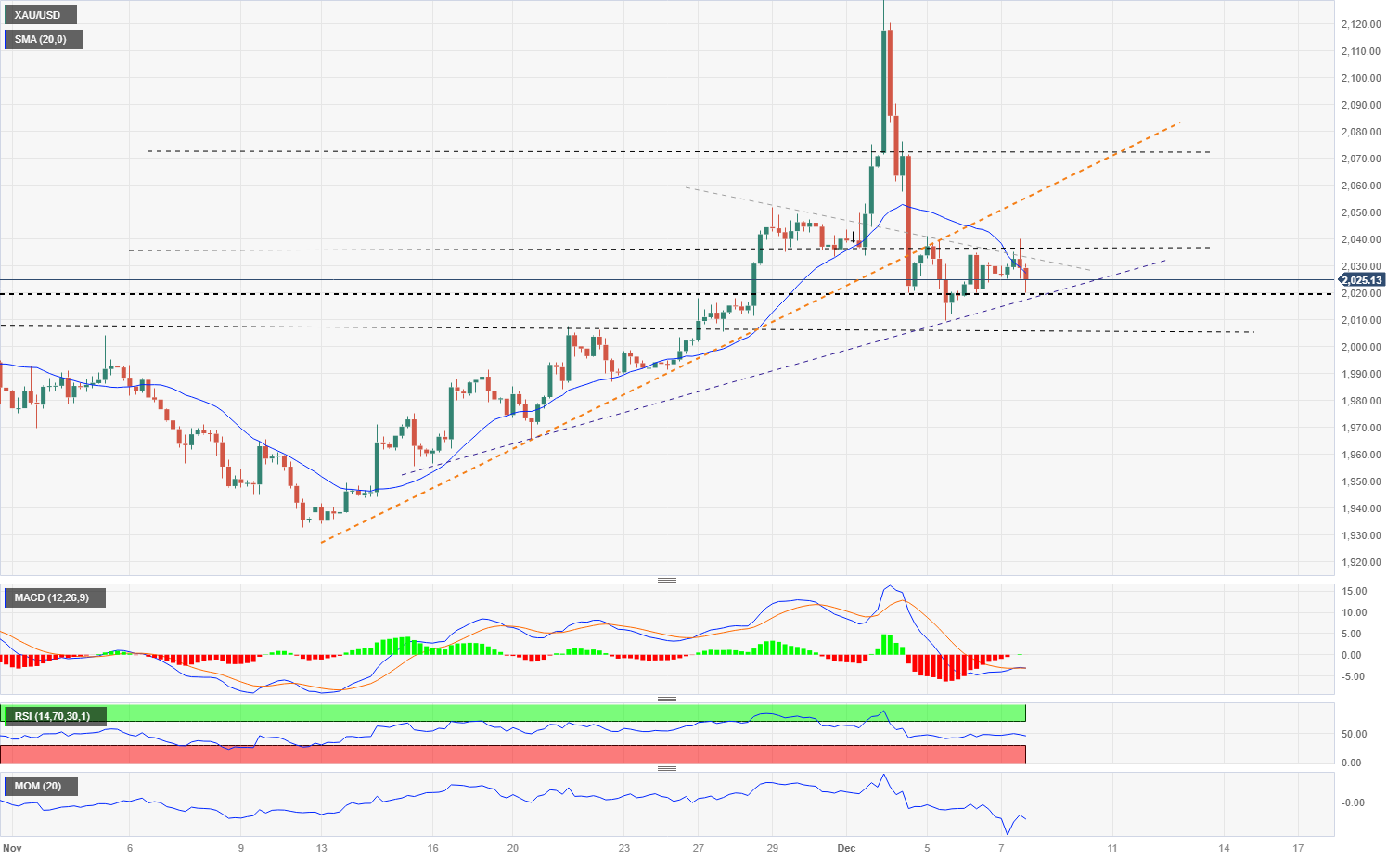

XAU/USD Current price: $2,023

- Gold still faces bearish pressure despite lower Treasury yields.

- Market participants await more US labour market data.

- XAU/USD faces strong resistance at $2,040.

Gold spot is moving sideways without a clear direction in the short term, as the upside faces resistance at $2,040 and lower Treasury yields limit the downside. The negative momentum from the retreats from all-time highs near $2,130 still shows signs of life.

The sharp drop in XAUD/USD has caused damage, and the wounds are still visible. However, the positive aspect is that the price has so far avoided further losses, suggesting that consolidation could persist. On the fundamental front, the sideways moves reflect the market’s conviction that the Federal Reserve (Fed) won’t raise interest, and they foresee rate cuts in 2024, but after other central banks start loosening monetary policy. This could be negative for the US Dollar, but the fundamentals remains one of the strongest among G10 currencies considering GDP growth and the outlook.

For Gold to resume the upside, some modest weakness in the US Dollar appears to be needed. Additionally, yields should continue to stay away from any significant rebound. This context should bring Gold back near record highs at some point in time. Data from the US on Thursday came in mixed, with the highlight of Continuing Jobless Claims pulling back sharply after last week’s surge. The focus now turns to Friday’s Nonfarm Payroll, with an expected increase of 180,000. Next week, is the FOMC meeting, and before that, on Tuesday, the US Consumer Price Index is due.

XAU/USD short-term technical outlook

Gold continues to move around the $2,025 area, still facing some bearish pressure after the sharp reversal from record-high levels. A strong support area emerges at $2,020 and $2,010. On the daily chart, the trend is up, and prices remain above key simple moving averages.

Technical indicators are starting to flatten, offering signs of support for gold.

On the 4-hour chart, technical indicators are flattening around midlines, offering no clear bias. On the upside, the immediate resistance is at $2,040, and a break higher could lead to a test of the next level at $2,050. On the downside, for gold to resume losses, it would need to slide and stay below $2,020.

Support levels: $2,020 $2,010 $1,990

Resistance levels: $2,040 $2,055 $2,072