AUD/USD Current Price: 0.6762

- The AUD/USD broke higher on Tuesday as the Santa Claus rally continues.

- The US Dollar remains under pressure, with the DXY approaching recent lows.

- Commodity prices maintain a positive short-term trend.

The AUD/USD broke above 0.6730, boosted by a weaker US Dollar, and jumped to 0.6774, reaching the highest level since late July. Equity markets continue to rally, providing support to Antipodean currencies.

The Reserve Bank of Australia (RBA) released the minutes from its latest meeting, where they decided to keep the key interest rate steady at 4.35%. The document showed that they considered raising interest rates but ultimately chose to keep them unchanged, with members opting to wait for further data. The market still anticipates rate cuts by the RBA next year. The “hawkish” minutes had a minor impact in boosting the Aussie.

The key driver on Tuesday was the weakening US Dollar across the board, driven by risk appetite and lower Treasury bond yields. The Dow Jones is heading for another record close, and commodity prices continue to rise. Treasury yields maintain a negative trend. This context favors the upside in AUD/USD.

Several Federal Reserve (Fed) officials presented their views, indicating that interest rate cuts are not the base case for now, but remain possible if inflation continues to slow towards the Fed’s target. However, they are not declaring victory on inflation. Despite this, the markets still anticipate rate cuts by the central bank next year and are positioning accordingly.

Housing data from the US released on Tuesday came in mixed, with Housing Starts at 1.56 million in November, above the expected 1.36 million, while Building Permits declined to 1.46 million, below the consensus of 1.47 million. More housing data is due on Wednesday with the Existing Home Sales report, along with the CB Consumer Confidence survey.

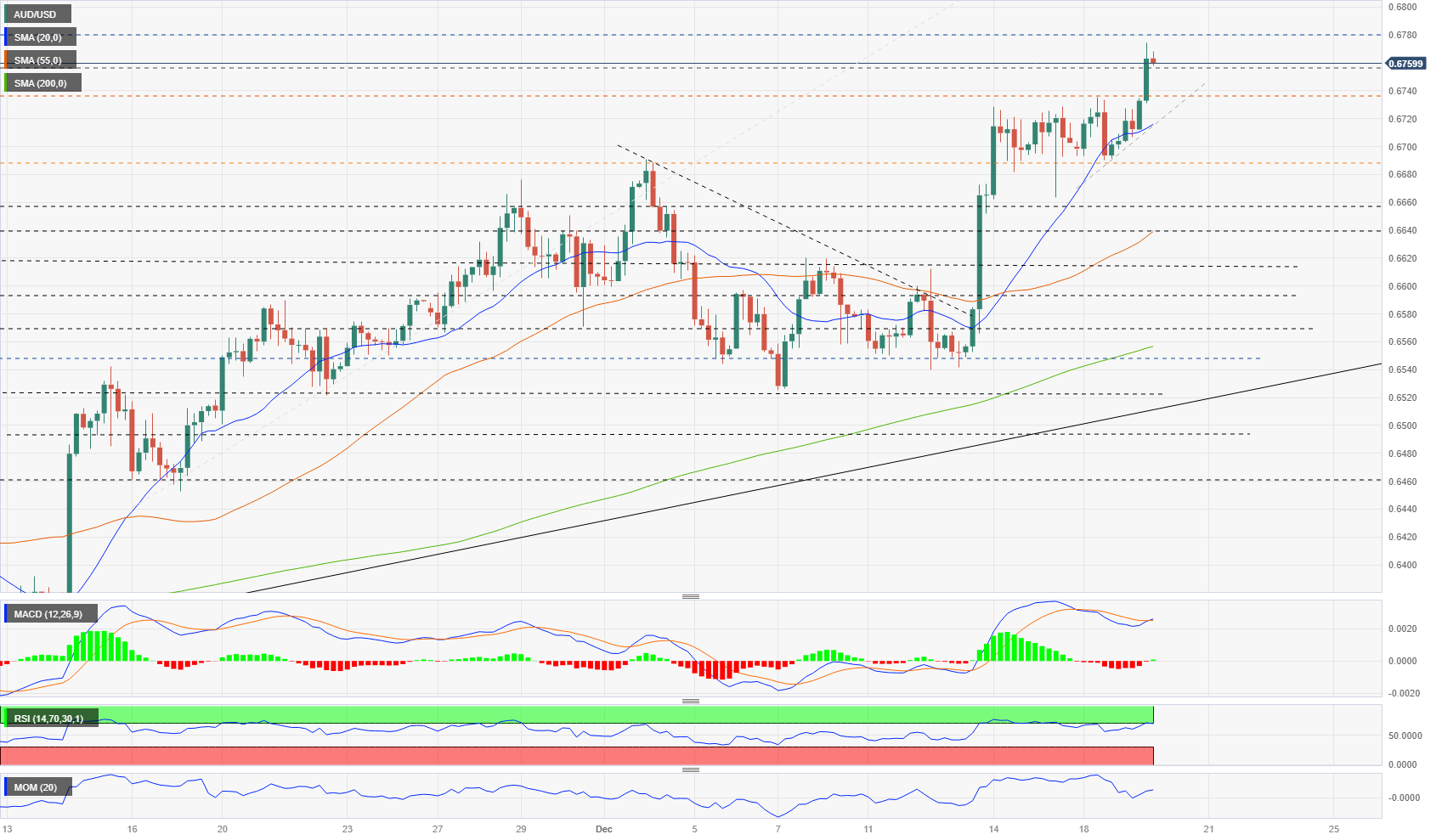

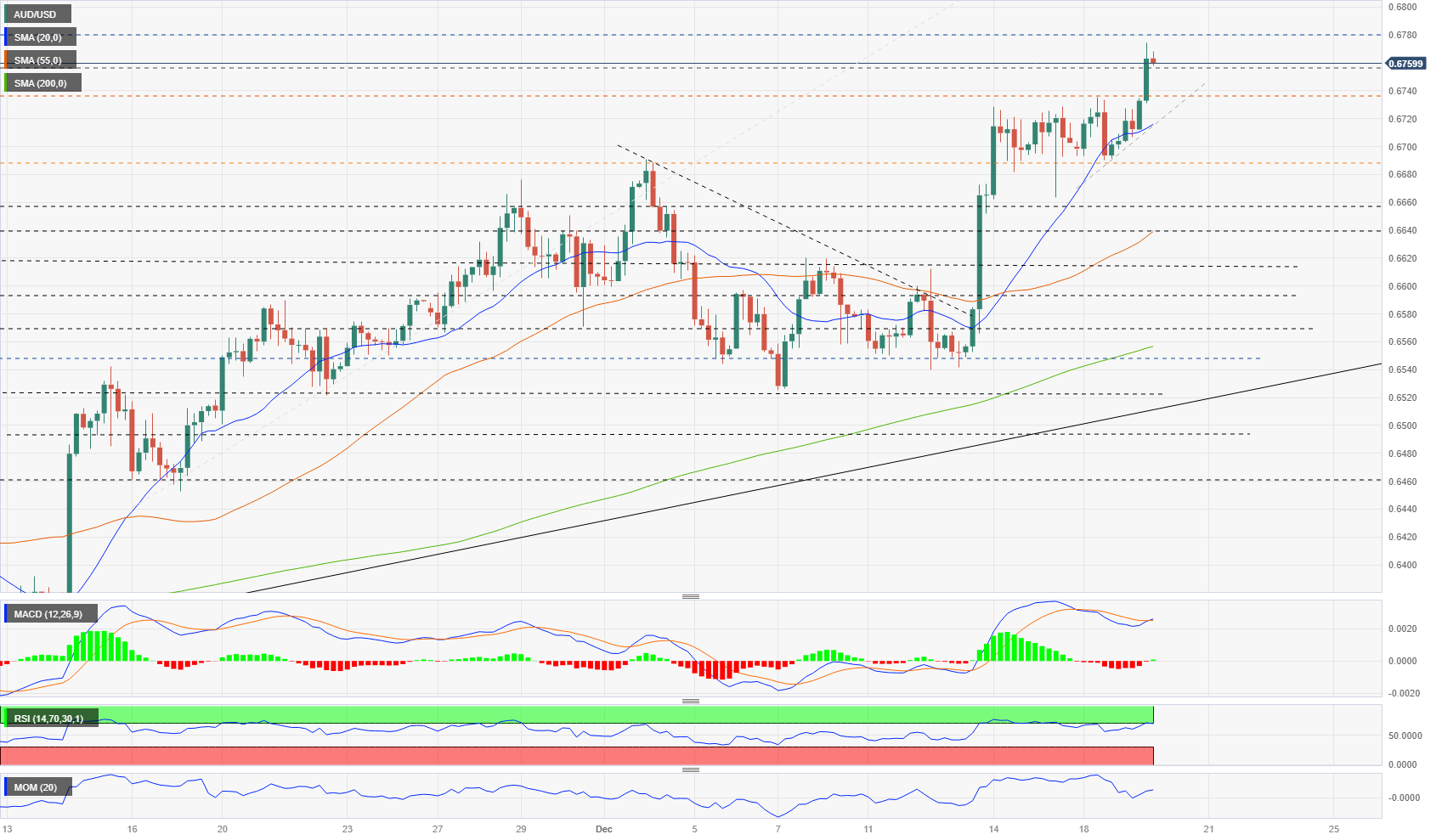

AUD/USD short-term technical outlook

The AUD/USD remains firm within a bullish channel, well above key simple moving averages. The upper limit of the range is around 0.6800, suggesting that if reached, it could lead to an downward correction. On the contrary, if it breaks above that level, an acceleration could occur. The Relative Strength Index (RSI) is approaching 70, indicating overbought conditions.

On the 4-hour chart, the momentum remains intact after the AUD/USD broke above the important resistance area at 0.6730, which now acts as support. However, the RSI is at overbought levels. The trend is upward, and above 0.6780, the next target is 0.6800. There is scope for further gains in the short term. However, considering market conditions, some consolidation between 0.6740 and 0.6770 is also possible.

Support levels: 0.6730 0.6690 0.6660

Resistance levels: 0.6770 0.6800 0.6820