AUD/USD Current Price: 0.8649

- The US Dollar slides across the board, boosting AUD/USD.

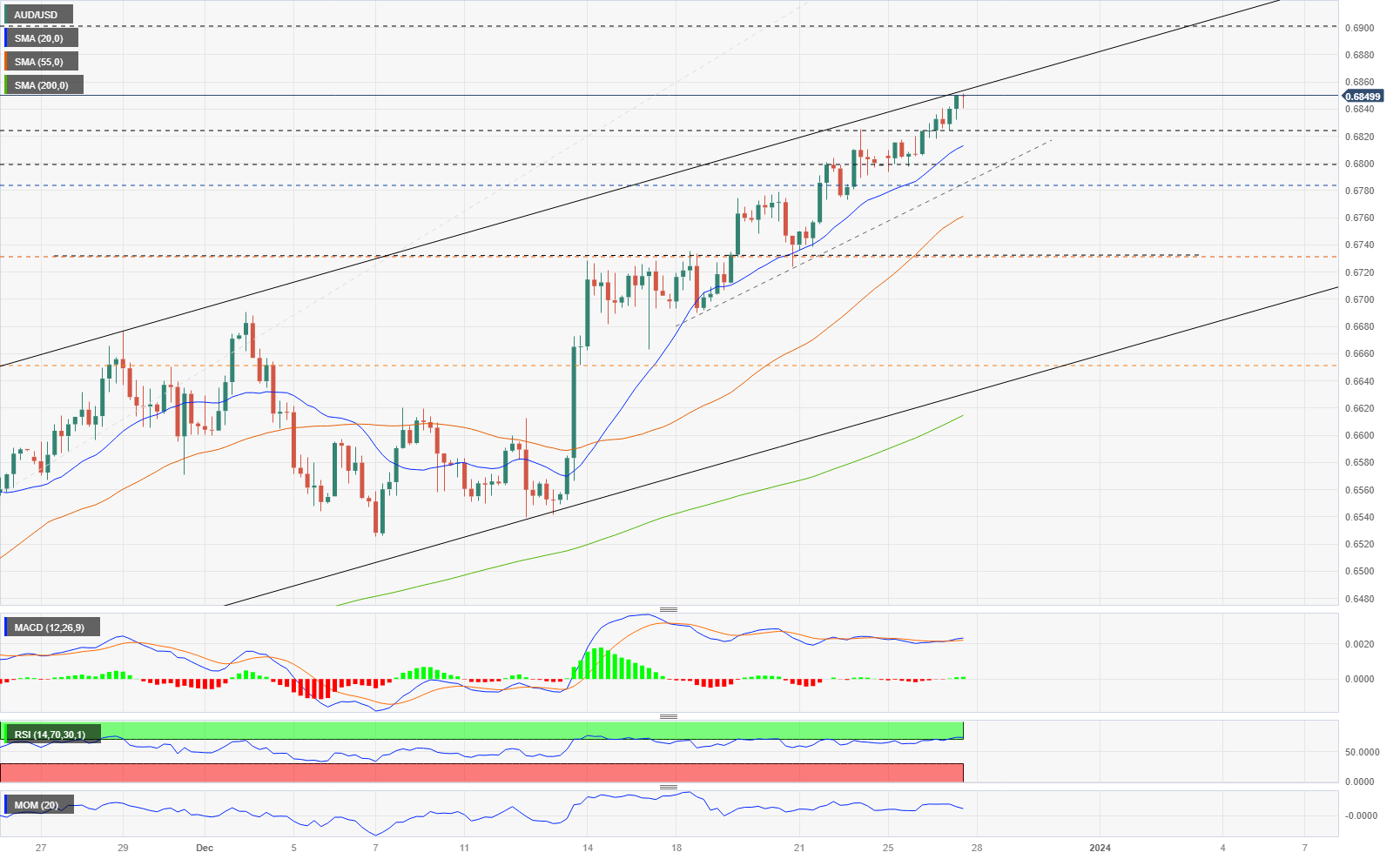

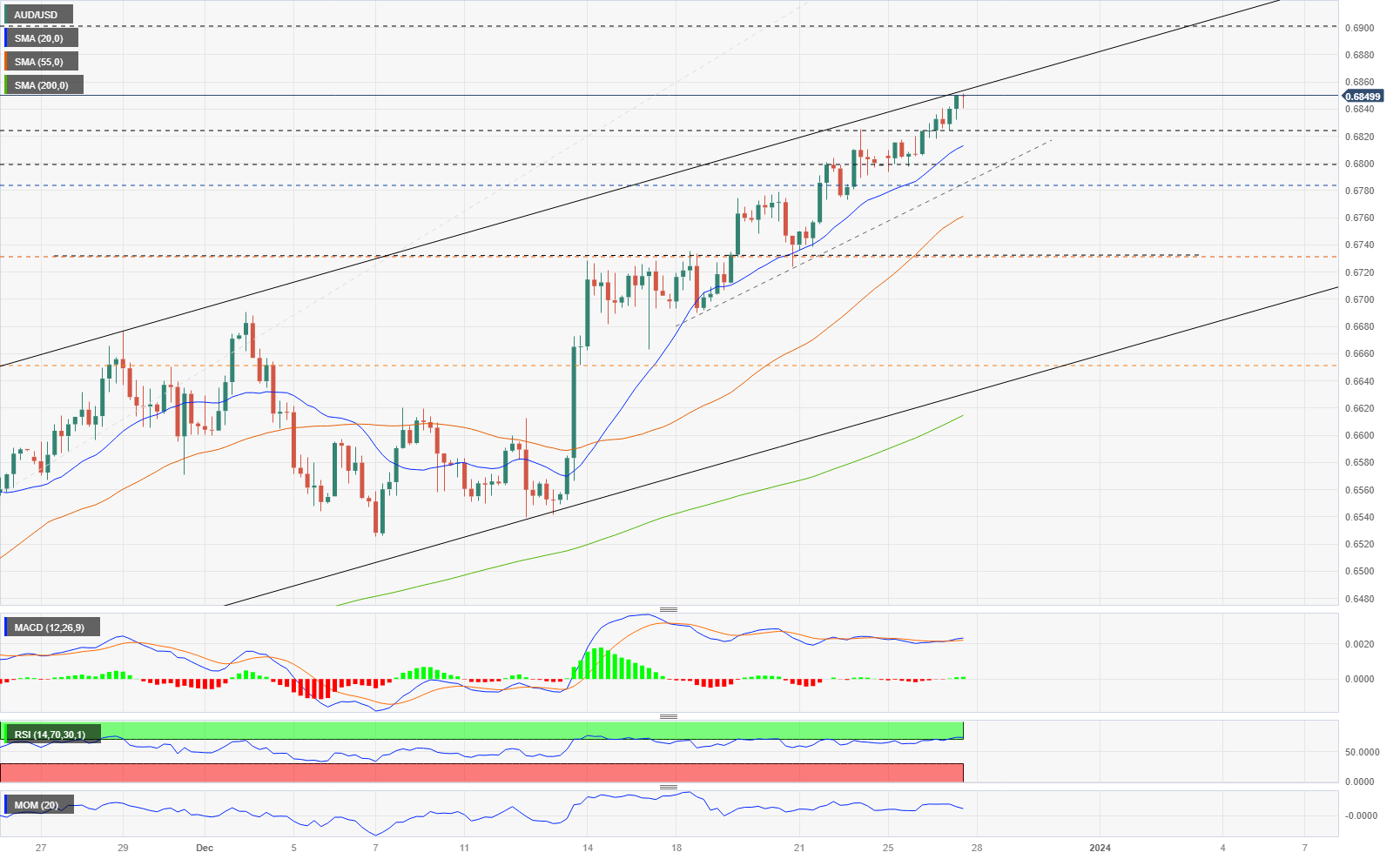

- The pair trades near the upper limit of an ascending channel.

- AUD/USD approaches 2023 highs and holds near the level it closed last year.

The AUD/USD broke firmly above 0.6800 and rose further to the 0.6850 area, reaching the highest level since July. The key driver behind this is a broad-based weakness in the US Dollar heading into the year-end.

Regarding economic data, no reports are due from Australia until 2024. In the US, data released on Wednesday showed the Richmond Fed Manufacturing Index falling from -5 to -11, below the expected -7. On Thursday, more important data is due with the weekly Jobless Claims report. The focus regarding data is on next week’s employment figures (JOLTS, ADP, and NFP).

The US Dollar Index (DXY) dropped to its lowest level since July, under 101.00. It remains under pressure, amid falling US Treasury Yields. Markets continue to bet on rate cuts from the Federal Reserve (Fed) next year.

The AUD/USD is headed towards the second monthly gain in a row, accumulating more than 500 pips of gains. The rally has eliminated 2023 losses and it is trading near the level it closed in 2022. The pair had a bearish bias for most of the year until November when it rebounded sharply, and then accelerated in December after the latest FOMC meeting, which included the now-famous rate cut forecasts from policymakers.

AUD/USD short-term technical outlook

The AUD/USD continues to trade within an ascending channel, near the upper limit of the range that stands at 0.6855. That level is an important resistance that should cap the upside. However, if the Aussie breaks above it, it could accelerate. The bullish bias will remain intact as long as it stays above 0.6660.

On the 4-hour chart, technical indicators offer mixed signals. The Relative Strength Index (RSI) is at overbought levels but flat, suggesting potential exhaustion but not necessarily anticipating an immediate correction. The MACD is also flat, lacking clear direction. The upside remains solid, with price well above the 20-period Simple Moving Average and above upward trendlines. The chart indicates a clear bullish bias, with overbought conditions. A break below 0.6815 would weaken the Aussie.

Support levels: 0.6820 0.6795 0.6750

Resistance levels: 0.6850 0.6875 0.6905