- EUR/USD fluctuates near 1.0950 to start the new week.

- A negative shift in risk mood could make it difficult for EUR/USD to gain traction.

- 1.0920 aligns as a key support in the near term.

EUR/USD managed to erase its daily losses after dipping below 1.0900 on Friday but closed the first week of 2024 in negative territory. The pair’s near-term technical outlook fails to provide a directional clue in the near term and investors are likely to pay close attention to risk perception in the absence of high-tier macroeconomic data releases.

Mixed macroeconomic data releases from the US caused EUR/USD to fluctuate wildly in the American session on Friday. After losing nearly 50 pips and dropping below 1.0900 with the immediate reaction to the December jobs report, the pair made a sharp U-turn and advanced to the 1.1000 area.

Nonfarm Payrolls in the US rose by 216,000 in December. Although this reading came in better than the market expectation for an increase of 170,000, downward revisions to November and October prints caused the US Dollar (USD) rally to remain short-lived. Additionally, the Unemployment Rate held steady at 3.7% even as the Labor Force Participation Rate declined to 62.5% in December from 62.8%. Finally, the ISM Services PMI slumped to 50.6 in December from 52.7 in November, highlighting a loss of momentum in the service sector’s business growth.

US stock index futures trade in negative territory early Monday on escalating geopolitical tensions and fears over the debt crisis in China’s property sector spilling into the broader financial sector. A bearish opening in Wall Street could help the USD stay resilient against its rivals in the second half of the day.

The European economic docket will feature Retail Sales for November and business sentiment data for December. Earlier in the day, the data from Germany showed that Factory Orders increased by 0.3% on a monthly basis in November. This reading fell short of analysts’ estimate for a 1% growth but failed to trigger a noticeable market reaction.

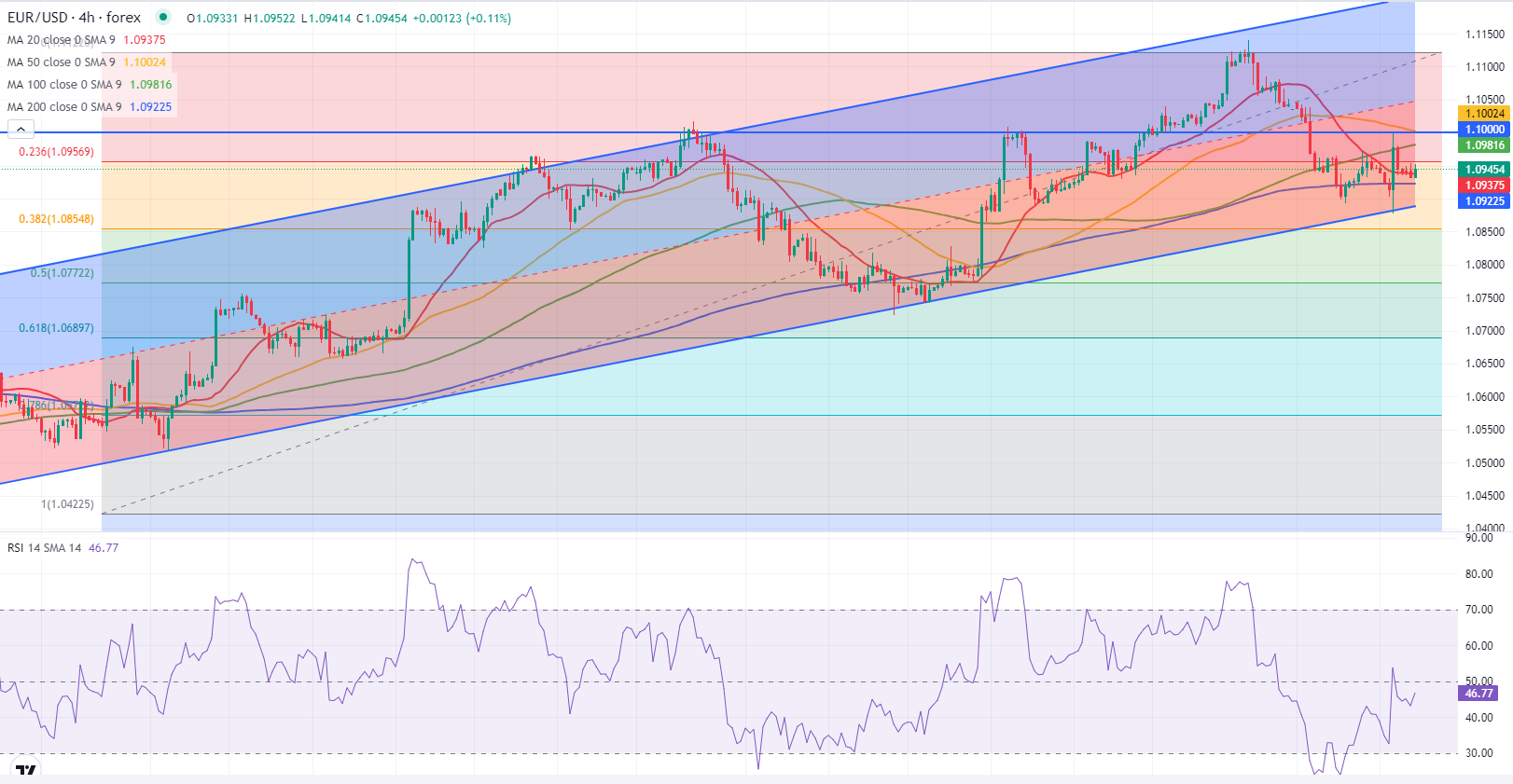

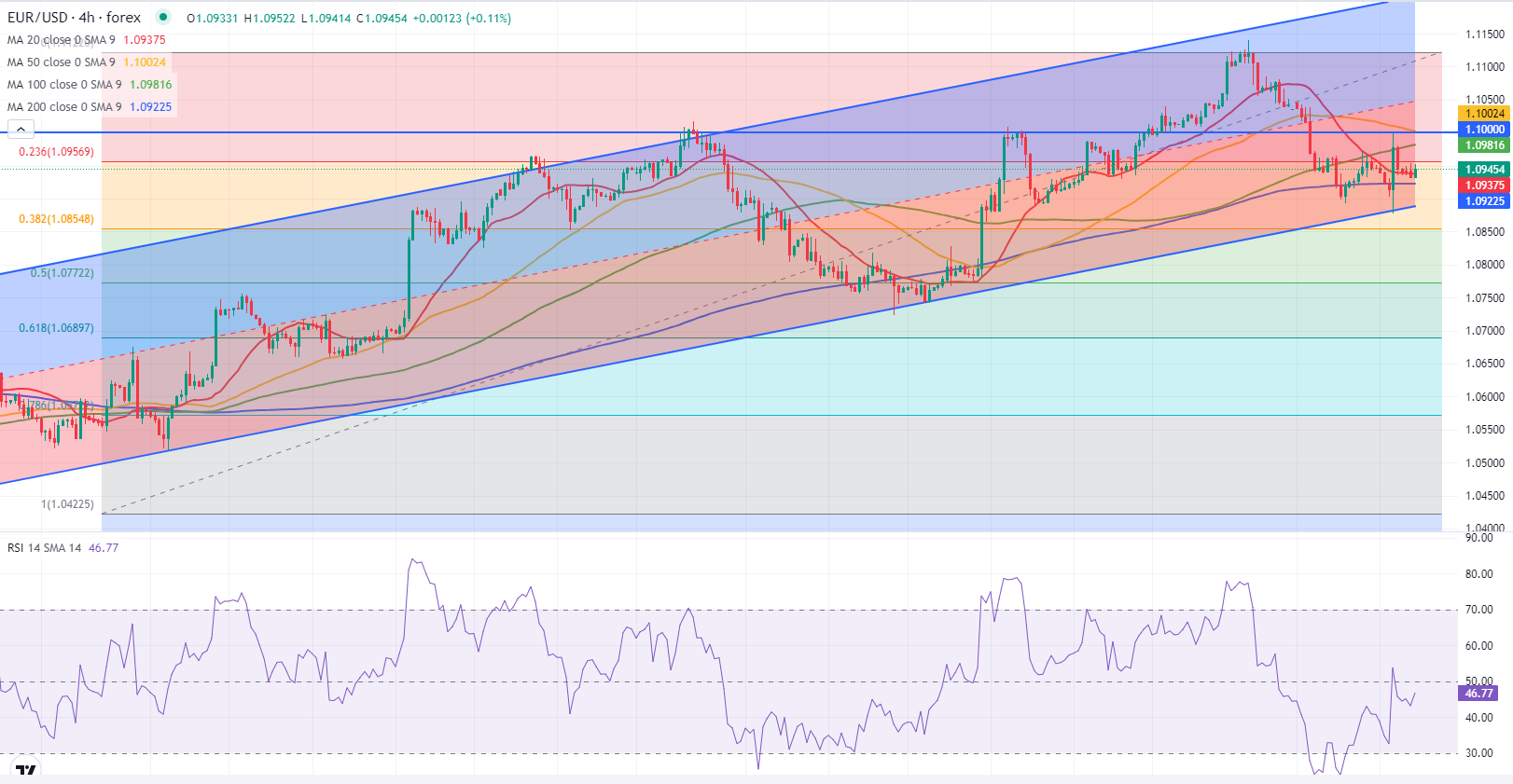

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart recovered toward 50, pointing to a loss of bearish momentum. EUR/USD, however, stays dangerously close to 1.0920, where the 200-period Simple Moving Average (SMA) is located. Below this level, 1.0890 (lower limit of the ascending regression trend channel) could act as next support before 1.0850 (Fibonacci 38.2% retracement of the latest uptrend).

On the upside, 1.0980 (100-period SMA) could be seen as the first resistance before 1.1000 (psychological level, 50-period SMA) and 1.1050 (mid-point of the ascending channel).