- Federal Reserve Chairman Jerome Powell cooled down hopes for a March rate cut.

- The US Nonfarm Payrolls report shocked markets with 353K new jobs added.

- EUR/USD bearish case stronger in the long run, 1.0780 immediate downside barrier.

Demand for the US Dollar prevailed these last few days, and EUR/USD ended a third consecutive week with losses at around 1.0800, with the pair remaining depressed and bulls having no reasons to buy the Euro.

The focus was on the United States (US) as the Federal Reserve (Fed) announced its monetary policy decision, while the local macroeconomic calendar was packed with employment-related data.

The Fed left the benchmark rate steady at 5.25%-5.5% as largely expected, but noticeable changes in the Federal Open Market Committee (FOMC) statement and comments from Chairman Jerome Powell triggered risk-off, sending stocks nose-diving and boosting demand for the US Dollar.

Powell dropped a bomb

But let’s go back to the Fed. The statement was mostly optimistic, as it remarked a solid pace of economic expansion, while policymakers acknowledged inflation has shown signs of easing. On the downside, officials noted the labor market is still strong, despite moderating job gains. Policymakers also dropped the wording on rate hikes and replaced it with a more moderate perspective of adjusting the monetary policy according to upcoming data. Finally, they added they need to gain enough confidence in inflation returning to 2% before trimming interest rates

Chairman Jerome Powell dropped a bomb in the press conference, as he cooled down the chance of a March interest rate cut. Powell said that it was not the base-case scenario, emphasizing the FOMC is “not really” at a stage where they could consider cutting rates.

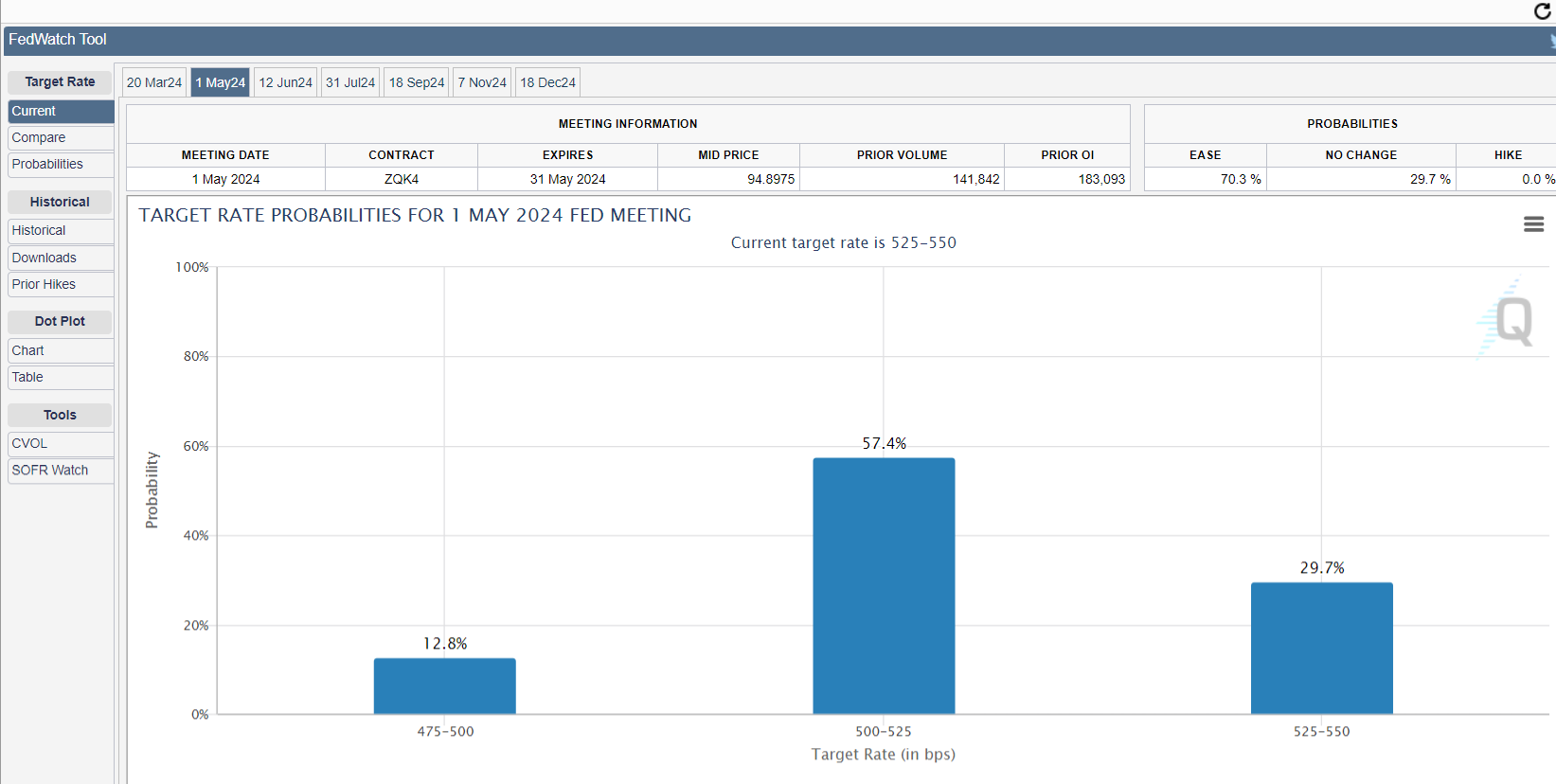

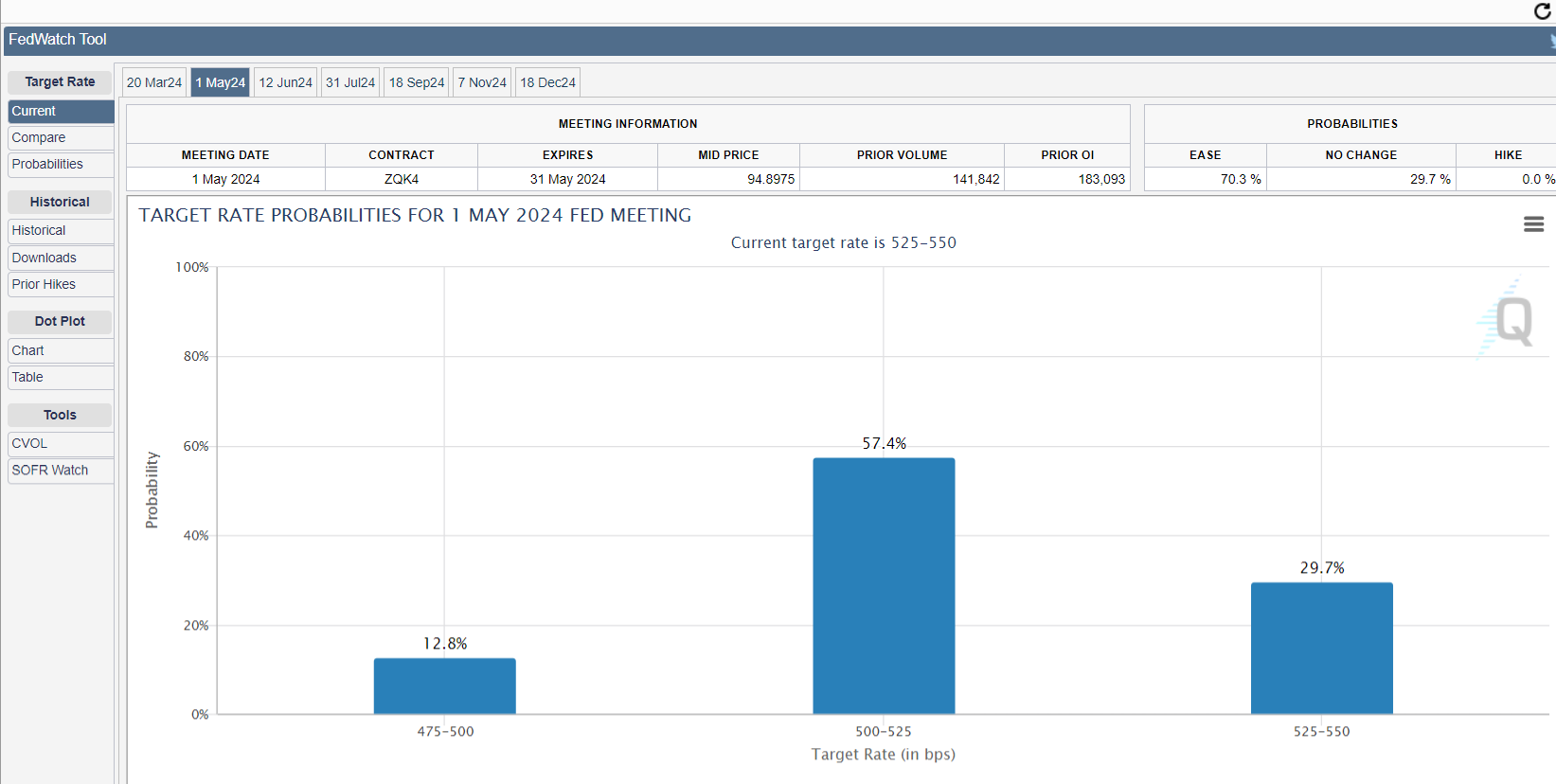

Following the initial bout of risk-aversion, the odds for a cut in March fell towards 34% after nearing 90% a few weeks ago. But speculative interest quickly recovered from the disappointment: money markets are now pricing in a 57.4% chance of 25 basis points (bps) cut in May.

What’s going on with Europe?

And while the US Dollar keeps swinging according to the market mood, the Euro is clearly being more affected by macroeconomic woes. Germany and the Eurozone released the preliminary estimates of their respective Q4 Gross Domestic Product (GDP). The German economy contracted by 0.3% in the three months to December, while the EU growth stood pat in the same period.

Meanwhile, inflation gave encouraging signs in January, as the German Harmonized Index of Consumer Prices (HICP) rose by 3.1% YoY, according to preliminary estimates, while the EU HICP rate printed at 2.8% YoY.

Falling inflation boosted hopes for a soon-to-come European Central Bank (ECB) rate cut, but the picture there is less clear than in the US. Following the central bank’s monetary policy announcement last week, President Christine Lagarde said that talks on the matter are “premature,” repeating the Governing Council will continue to be data dependant. However, some officials’ wording aims in the opposite direction. Earlier this week ECB Governing Council member Mario Centeno said the central bank should start bringing down interest rates sooner rather than later. “We can react later and more strongly, or sooner and more gradually,” Centeno added.

Additionally, ECB Vice President Luis de Guindos recognized that economic prospects have worsened since December and added that the Euro area’s growth could be weaker this year than the central bank predicted.

US employment sector offering mixed signals

Regarding the US employment sector, data releases throughout the week offered mixed signals, but pretty much confirmed the Fed’s assessment of the labor market remaining tight.

The Bureau of Labor Statistics (BLS) reported that the number of job openings on the last business day of December stood at 9.02 million, up from 8.92 million in November. The ADP survey on private job creation showed 107K new positions were added in January, below the market expectations of 145K.

Initial Jobless Claims for the week ended January 26 increased by 224K, above the market expectation of 215K. Additionally, Q4 Nonfarm Productivity rose 3.2%, beating expectations, while Unit Labor Cost in the same period increased 0.5%, less than the 1.7% expected.

On Friday, the US released the January NFP report, which rocked the FX board. The country added 353K new job positions, almost doubling the 180K anticipated. At the same time, the Unemployment Rate held at 3.7% vs an uptick to 3.8% expected. Finally, Average Hourly Earnings rose 4.5% YoY, higher than expected. The US Dollar soared with the news, as it further cooled expectations of rate cuts, with March odds now at 19.5%, although the chance of a May cut remains steady at around 60%.

Finally, much of the EUR/USD direction was set by stocks. After collapsing with the Federal Reserve’s announcement, US indexes turned higher amid impressive reports from the tech sector. The latter has set the tone this week, with the focus on companies working on artificial intelligence innovation. Stocks turned back south on Friday, following the impressive NFP report.

A bit of calm after the storm

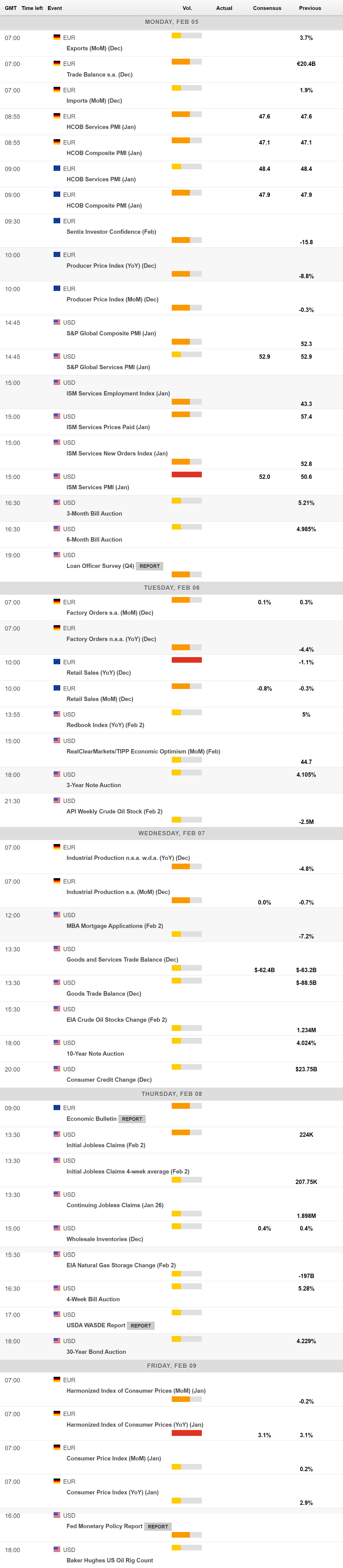

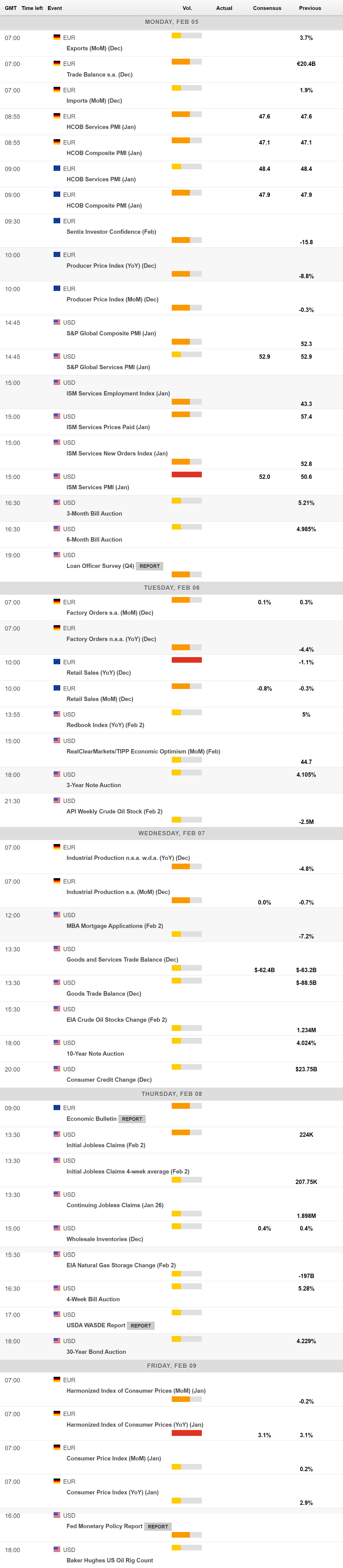

The upcoming week will be lighter in terms of macroeconomic data. The US will release the official ISM Services PMI, foreseen in January at 52.0 from 50.6 previously. The EU will publish December Retail Sales, while Germany will report the final estimates of the January HICP.

Given that central banks have announced their monetary policy decisions, policymakers will be more present in the wires. Speculative interest will start assessing such comments aiming to anticipate future decisions.

A word of caution, US companies will continue reporting earnings next week, and this could affect investors’ confidence intraday.

EUR/USD technical outlook

Technically, the weekly chart shows that the risk skews to the downside. EUR/USD is pressuring a directionless 20 Simple Moving Average (SMA), while the 100 SMA heads south below the shorter one. At the same time, the Momentum indicator gains downward traction within positive levels, while the Relative Strength Index (RSI) indicator anticipates further slides, currently standing at around 48.

On a daily basis, sellers are in control. EUR/USD retreated sharply after meeting sellers around a bearish 20 SMA and plunged below a directionless 200 SMA. The pair met buyers this week at 1.0779, with a flat 100 SMA reinforcing the support level. Finally, technical indicators resumed their slides within negative levels, with firmly bearish slopes.

Further declines are to be expected on a clear break of 1.0780, with the next support levels at 1.0700 and 1.0640. On the flip side, resistance can be found around 1.0850 and the 1.0920/30 region.