Introduction

In the complex world of global finance, the relationship between the US and the EU is crucial, significantly impacting the EURUSD currency market. This article explores how economic policies, geopolitical tensions, and monetary decisions affect this key currency pair, offering insight into global market dynamics.

US policies and their influence on forex markets

The US economy’s surprising resilience positively impacted the US dollar’s value in the foreign exchange market. An outstanding employment report for early 2024 showed an unexpected rise in non-farm payrolls, leading to a surge in Treasury bond yields and a stronger dollar. This surge and the increase in average hourly wages indicate a solid economic base, negating expectations of an immediate rate cut.

Economic growth of 3.3% annualized in Q4 2023, along with notable growth in consumer spending and private sector wages, has boosted consumer confidence. This synergy of real wage growth and consumer sentiment points to an optimistic outlook for the dollar, indicating solid economic conditions and the potential for tighter monetary policy to manage inflation and economic development. The Federal Reserve’s policy adjustments, including raising the federal funds rate to a range of 4.5% to 4.75%, underscore efforts to stabilize inflation towards the 2% target over time, reflecting a proactive stance in economic governance.

Geopolitical tensions, such as conflicts in Ukraine and the Middle East, impact the dollar by driving a flight to safety among investors, elevating the currency’s value amidst global uncertainties. Additionally, the dollar benefits from the US’s economic outperformance and continued growth expectations, attracting cross-border investments and strengthening its position against other currencies.

In addition, a rematch between Donald Trump and Joe Biden is expected ahead of the US election in 2024, with both scoring early victories in their parties’ nominations. The election cycle is centered on critical issues such as the economy, climate, social policy, and geopolitics, reflecting the complexity of the global and domestic environment. The evolving political scene, influenced by the results of the early primaries and essential issues such as immigration, will play a key role in shaping the political discourse and choices voters will face in 2024, especially considering such matters as the immigration crisis in Texas.

Euro dynamics: Between domestic policy and global influence

The economic outlook for the European Union is characterized by moderate growth and declining inflation amid domestic challenges and external geopolitical pressures. The gradual economic recovery is supported by projections that EU GDP will grow by 0.6% in 2023, improve slightly to 0.8% in 2024, and reach a more substantial growth rate of 1.5% in the following years.

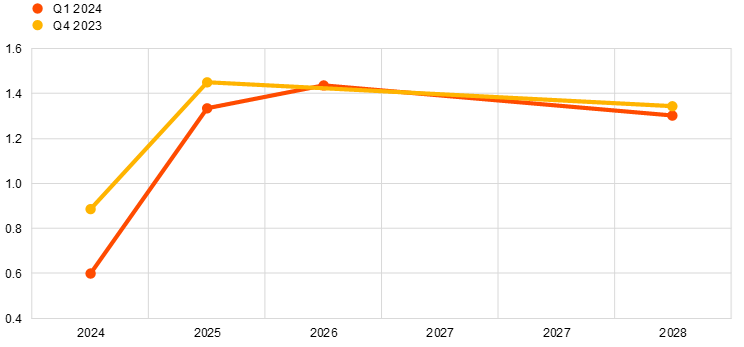

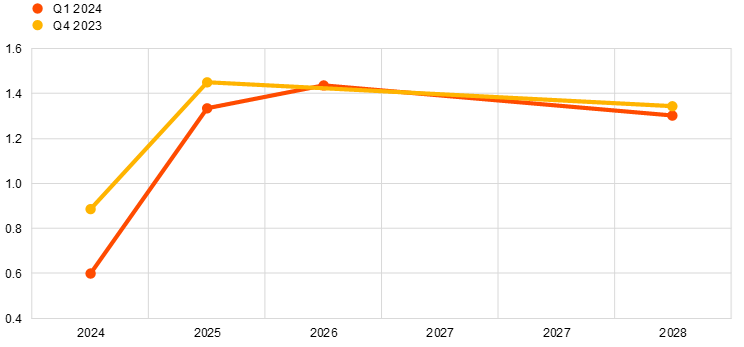

Expectations for GDP growth. Source: The European Central Bank (ECB)

Inflation, an essential worry, is expected to decline from 5.4% in 2023 to 2.7% in 2024 before falling to 2.1% by 2025. The European Commission’s Winter 2023 Economic Outlook contains an optimistic forecast of GDP growth of 1.6% in 2024 and a decline in inflation to 2.8% in the EU and 2.5% in the euro area, indicating the EU’s resilience in the face of energy shocks and inflationary pressures and its ability to avoid recession.

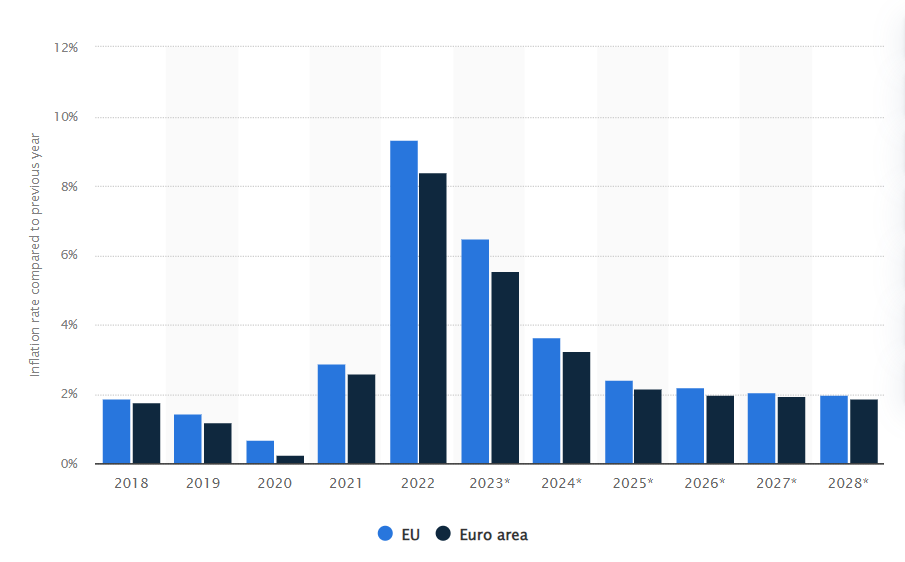

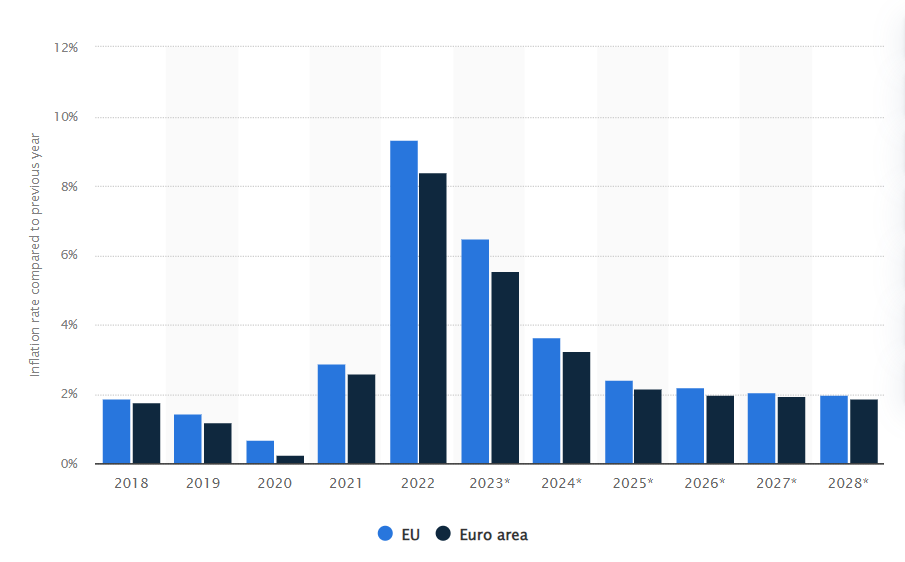

Inflation rate in EU and Euro area 2028. Source: statista.com

Germany, Europe’s largest economy, faces serious economic challenges, including stagnation and high inflation. The IMF and OECD have emphasized the financial situation in Germany, forecasting a 0.6% contraction in GDP this year amid a slowing global economy and high-interest rates that will persist into the new year. However, there are signs of a potential turnaround: the German economy is expected to recover moderately, forecasting GDP growth of 0.8% in 2024 and 1.2% in 2025. This is supported by desired improvements in domestic demand, driven by rising real wages, and a recovery in external demand despite the challenges posed by inflation and sluggish global conditions. German inflation is projected to fall to 3.1% in 2024 and 2.2% in 2025, while unemployment will stabilize at 3.2%.

The EU economy and the euro’s strength against the dollar are significantly influenced by the European Central Bank’s monetary policy and the EU’s ability to deal with foreign policy issues. These include trade relations and geopolitical tensions, affecting the economic outlook and investor sentiment towards the euro. As the EU and its member states, especially Germany, address these economic and geopolitical challenges, their success in maintaining stability and stimulating growth will play a key role in shaping EUR/USD’s momentum.

Fed and ECB monetary policy

The Federal Reserve’s approach to monetary policy has been marked by caution, focusing on achieving greater confidence that inflation will consistently trend towards the 2% target before considering rate cuts. Despite inflation easing to 3.1%, according to the Fed’s preferred measure, the Fed has maintained its policy rate steady in the 5.25%-5.5% range since last July. This cautious stance suggests that while rate cuts are in view for 2024, they are expected to be gradual and systematic. Federal Reserve Chair Jerome Powell has underscored the strength of the labor market and the economy, indicated a solid foundation, and emphasized that inflation remains too high for immediate policy easing. The timing and pace of future rate reductions remain contingent on continued progress in inflation reduction and economic performance.

At the same time, in 2024, the European Central Bank will address economic challenges, focusing on reducing inflation and stabilizing the economy in the euro area. Economic forecasts point to a gradual economic recovery: GDP growth is expected to increase from 0.6% in 2023 to 0.8% in 2024, while inflation is likely to fall from 5.4% in 2023 to 2.7% in 2024, with a further decline to 1.9% by 2026.

Despite adverse economic factors, the labor market remains resilient, with unemployment at 6.4% in the first quarter of 2023 and wage growth at 5.2% year-on-year. The ECB left key interest rates unchanged after a cumulative increase to 3.5% and plans to reduce the portfolio of the emergency purchase program (PEPP) by €7.5 billion per month in the second half of 2024, demonstrating its cautious but proactive approach to steer the euro area towards sustainable growth and price stability in the face of ongoing economic fluctuations.

Technical analysis of EURUSD

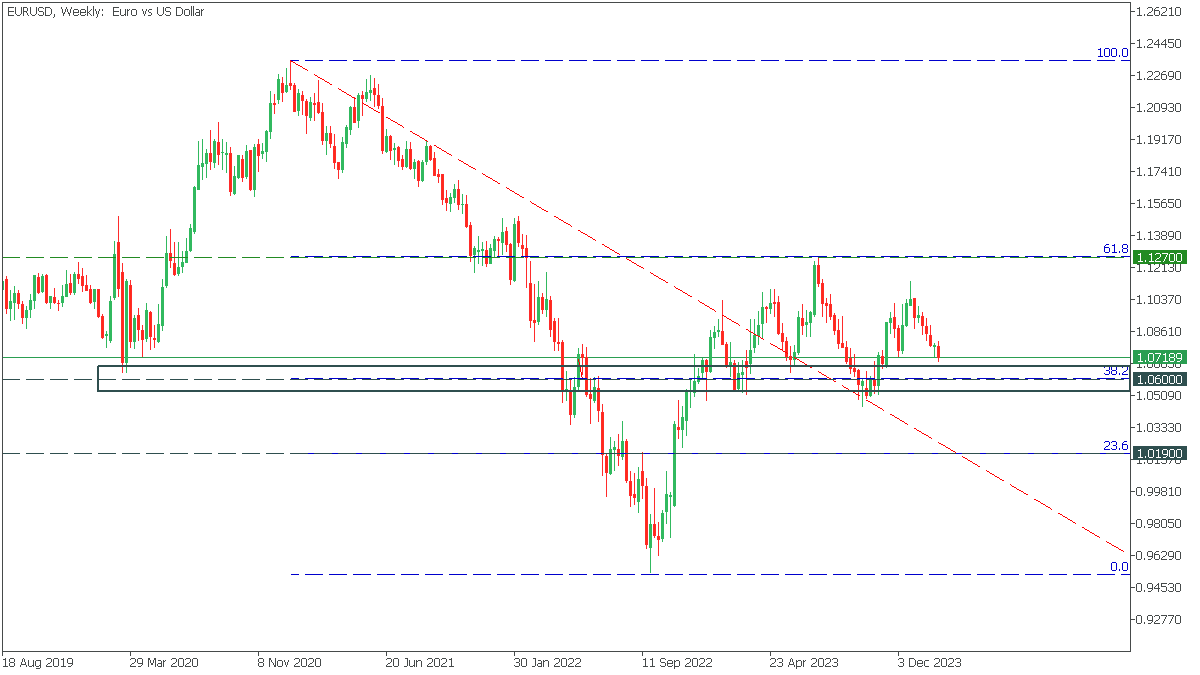

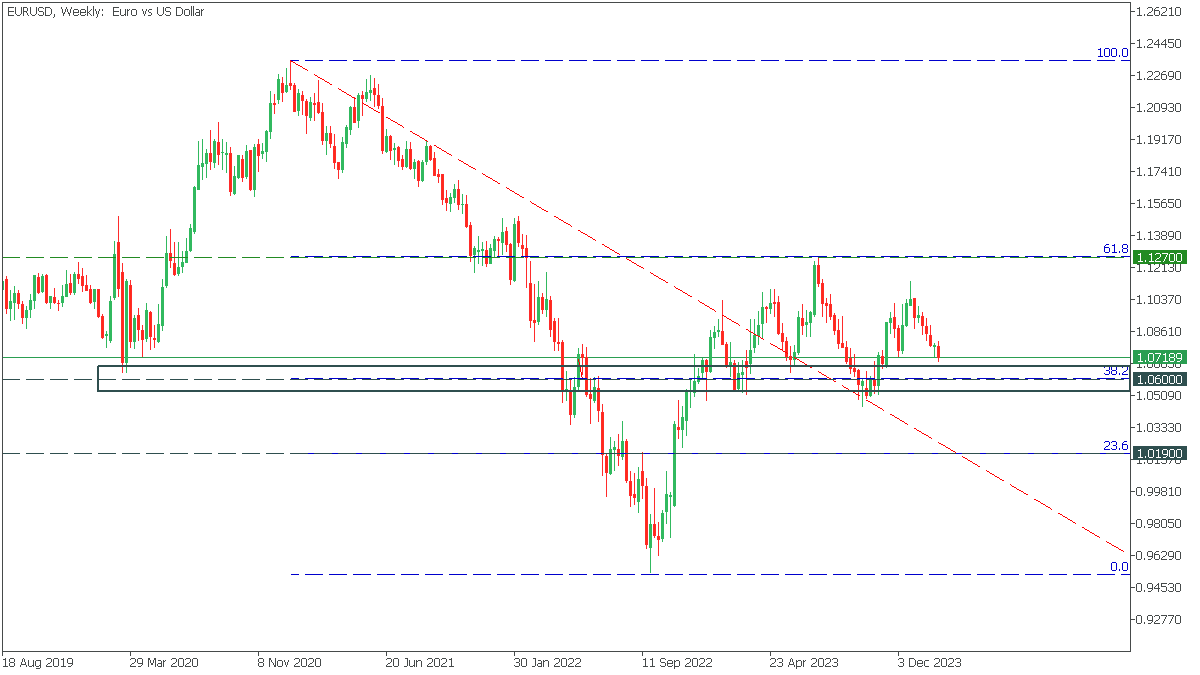

EUR/USD, weekly timeframe

The EURUSD has recovered after a prolonged decline and is currently in a significant consolidation with no apparent signs of a trend. In 2024, who will start cutting the critical rate sooner will be very important. Given the recent US CPI, we can assume that the ECB will cut the rate earlier, which could signal a further decline. If the price manages to overcome and consolidate below the support area of 1.0600, another fall to 1.0190 is possible.

However, if the Fed goes for an interest rate cut sooner, EURUSD will bounce off the support, and the price will continue to rise to the resistance level of 1.1270, corresponding to 61.8 Fibonacci. In this case, keeping an eye on current events is crucial.

Conclusion

Domestic and external issues in the US and EU significantly impact the EURUSD, which is regularly confirmed by price movements. Further movement of the currency pair will depend on how successfully the United States and the European Union governments can resolve the accumulated problems effectively.

While the US Federal Reserve is taking a cautious approach to interest rate cuts, prioritizing a sustained decline in inflation, the European Central Bank’s decisions are driven by the state of the Eurozone economy. This delicate balance emphasizes the importance of closely monitoring economic indicators, policy decisions, and global developments to anticipate their implications for EURUSD.

This article is sponsored content