Despite a number of financial releases due out this week being quite interesting, on a monetary level, RBNZ’s interest rate decision caught our attention. In contrast to other central banks, the market’s expectations for RBNZ to ease its monetary policy tend to be rather low.

The Macroeconomics

Currently inflation in New Zealand, despite easing considerably since late 2022, remains potentially one of the main problems of New Zealand’s economy. It’s characteristic how the headline CPI rate slowed down from 7.2% yoy in late 2022 to 4.7% yoy in Q4 2023. Yet the rate is still above the bank’s target range of 2.00±1.00% adding more pressure on the bank to maintain a tight monetary policy for longer. Particularly prices in household & utilities, rent and food inflation tend to remain stubbornly high and above the target, thus posing substantial problems in the everyday life of New Zealanders. Yet given the bank’s dual mandate to watch over inflation and promote maximum employment at the same time, forces us to turn our attention also on New Zealand’s employment market as another factor which will determine the bank’s stance. It should be noted that the unemployment rate is currently at 4% which is considered rather low, yet is rising albeit at a slower pace than what was expected. Furthermore, the job growth rate seems to remain somewhat healthy. At the same time the labour cost index growth rate tends to remain relatively high despite slowing down somewhat over the past two quarters, implying that the labour market may continue feeding inflationary pressures in the short term. As a general comment, we could say that the employment market is still holding its tightness despite some cracks starting to appear, which may allow the bank to maintain a firm stance. As the main reason of worries for New Zealand’s economy we note the growth factor. New Zealand’s economy suffered a wide contraction over Q3 and if combined with RBNZ’s tight monetary policy, one could reasonably expect it to fall into a recession. Despite this not being part of the bank’s mandate as such, it may still add pressure on the bank to start easing its monetary policy.

The interest rate part of the decision

For the time being we note that currently, the market is pricing in the possibility of the bank remaining on hold, keeping the official cash rate (OCR), at 5.5%, by 77% according to NZD OIS, with the other 23% implying that a 25 basis points rate hike is also possible. Please note that the ICR is currently at a 15 year high level, The market also seems to be pricing in the possibility that the bank is to remain on hold for a prolonged period and actually proceed with a rate cut of 25 basis points in November. Overall we tend to concur the wit the market expectation for the bank to remain on hold in tomorrow’s meeting as a base scenario that may disappoint somewhat Kiwi traders, at least those expecting a rate hike, thus weighing slightly on the Kiwi. Yet we have to note that in its projections the bank at its last meeting did not seem to expect a possible rate cut in 2024 and as a word of caution, please note that the bank did not hesitate in the past to ignore market expectations, routing for a more independent path. In regards to the OCR we expect the bank to maintain a wait-and-see position for the time being. Should the bank remain on hold as expected, we may see attention being shifted to the accompanying statement and RBNZ Governor Orrs’ press conference later on.

The tone of the decision

Overall, we expect the bank to maintain a strong hawkish tone, given that inflation despite slowing down is still above the bank’s target. It’s characteristic that in the last statement, the bank mentioned in its forward guidance that “The Committee is confident that the current level of the OCR is restricting demand. However, ongoing excess demand and inflationary pressures are of concern, given the elevated level of core inflation. If inflationary pressures were to be stronger than anticipated, the OCR would likely need to increase further”. So the element of a potential rate hike is still present and if repeated as expected could provide some support for the Kiwi. Overall we expect the bank to remain hawkish in both Andrian Orrs’ press conference and the accompanying statement, also as it may want to push back against the pressure being exercised on the bank for an earlier rate cut. Hence we expect the tone of the decision to be leaning more on the hawkish side and should its hawkishness exceed market expectations we may see the release supporting the Kiwi.

Technical analysis

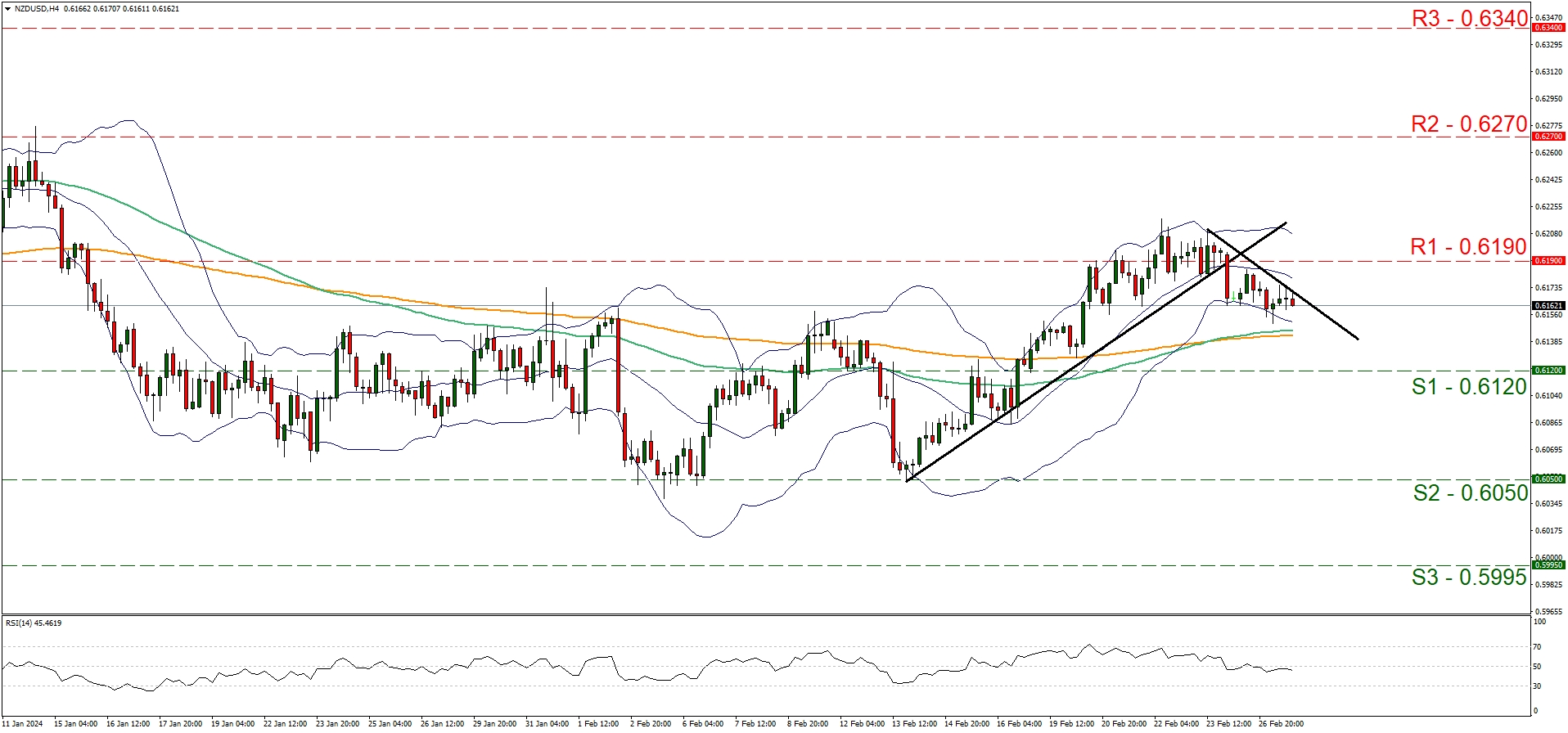

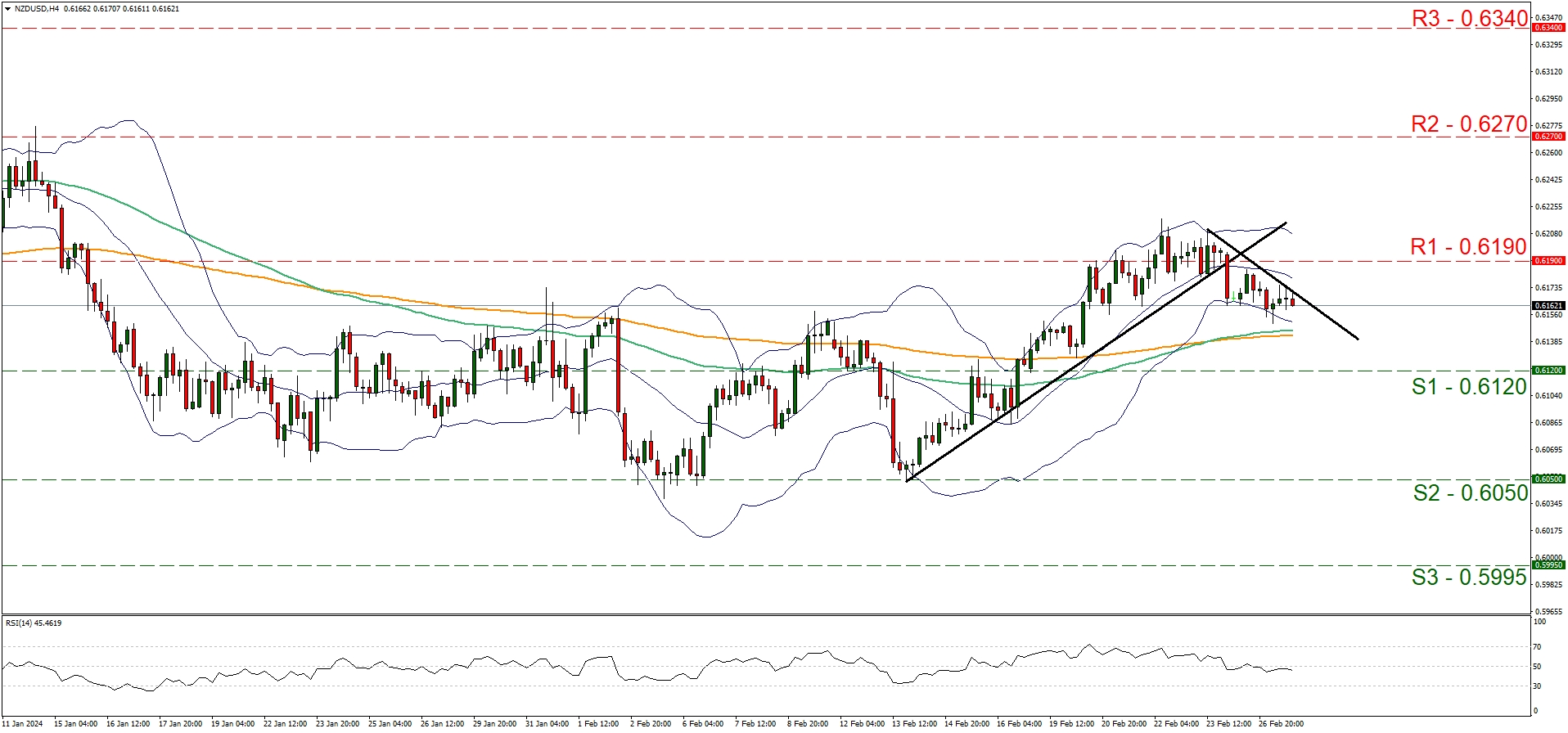

NZD/USD H4 Chart

- Support: 0.6120 (S1), 0.6050 (S2), 0.5995 (S3)

- Resistance: 0.6190 (R1), 0.6270 (R2), 0.6340 (R3)

On a technical level, we note that NZD seems to be losing some ground against the USD in the past few days. It should be noted that the downward movement of NZD/USD started after breaking the upward trendline guiding the pair since early on the 26th of February, as the week began. Furthermore, we also note that the RSI indicator has dropped below the reading of 50, implying that any bullish sentiment in the market has faded away, yet we tend to remain unconvinced that a bearish sentiment has been building up, at least not yet. We do note some tendency for a stabilisation of the pair’s price action. A first signal for a switch towards a sideways movement bias would be a possible breaking of the downward trendline guiding the pair since Friday, yet without the pair nearing the R1 nor the S1. For a bullish outlook besides the breaking of the prementioned downward trendline we would require the pair to also break the 0.6190 (R1) resistance line, thus opening the gates for the 0.6270 (R2) resistance hurdle. Yet our base scenario on a technical level, for now remains bearish in direction, yet we would still require the pair to form a lower low, thus the pair has to start aiming for the 0.6120 (S1) support line, while even lower we note the 0.6050 (S2) support base that was able to withstand the bearish pressure of the pairs’ price action on the 5th and the 14th of February.