The dollar index was sharply lower after mixed US labor data which showed hiring above expectations in October, but higher unemployment and lower wage inflation, warning that job growth may slow in coming months.

Although the data suggest loosening in the labor sector’s activity that implies the Fed may also start slowing its policy tightening, the latest comments from Fed Chair Powell signal that the central bank will remain on path to continue its hawkish monetary policy stance.

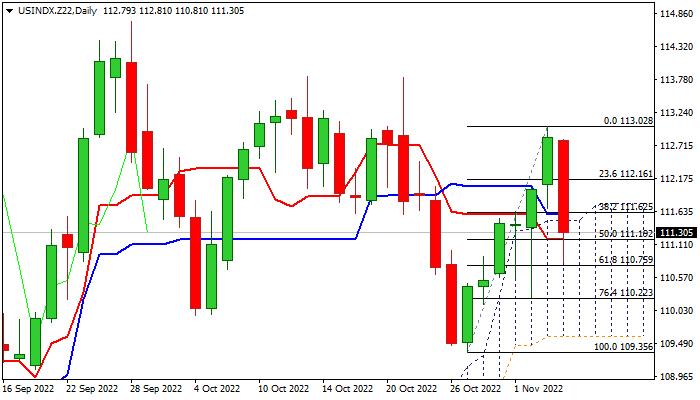

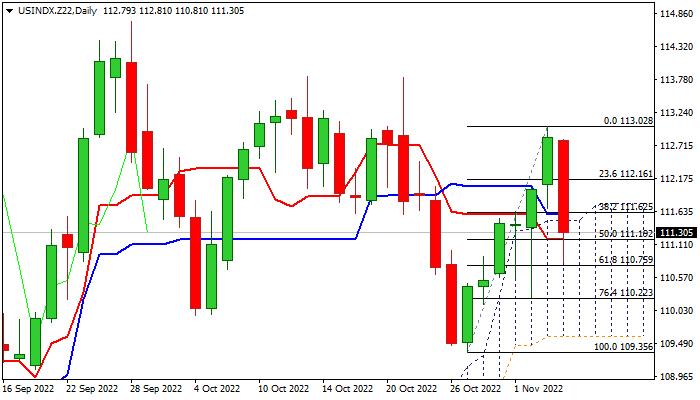

The dollar was down over 1.5% by the mid-US session on Friday and developing reversal signal on daily chart, as today’s strong fall has retraced nearly 61.8% of 109.35/113.02 upleg.

Fresh bearish acceleration also penetrated thick daily cloud, with broken top (111.49) reverting to strong resistance and today’s close within the cloud would add to negative signals, reinforced by growing bearish momentum and south-heading stochastic emerging from overbought territory.

This would keep fresh bearish bias for possible extension through 110.75 pivot (Fibo 61.8% / 55DMA) towards psychological 110 support.

Res: 111.49; 111.62; 112.16; 112.81

Sup: 111.19; 110.75; 110.22; 110.00