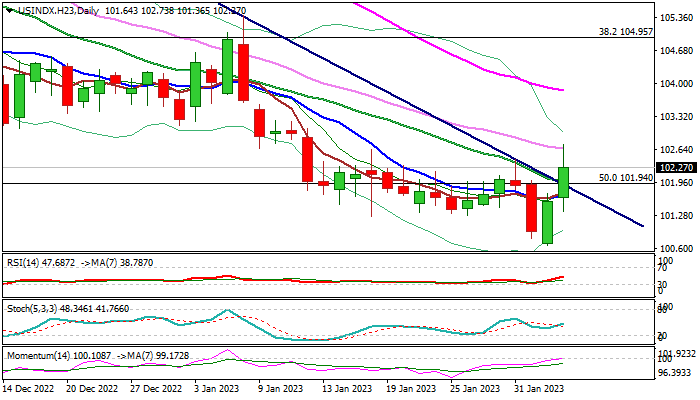

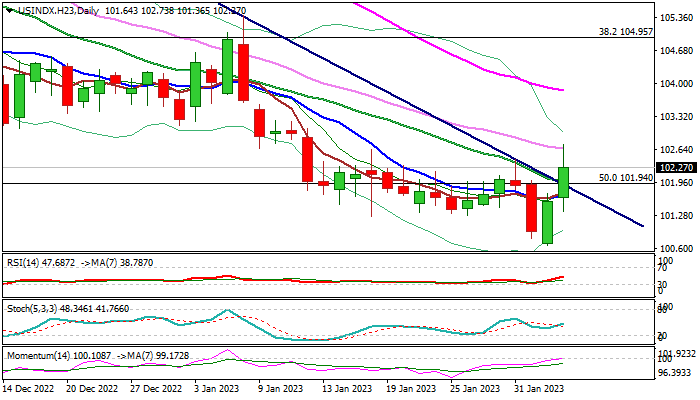

The dollar index jumps to three-week high on Friday, following hot US labor report (Jan 517K vs 185K f/c) and upbeat non-manufacturing PMI (Jan 55.2 vs 50.4 f/c and Dec 49.2) that greatly improved dollar’s sentiment.

The greenback extends strong bullish acceleration into second consecutive day, generating bullish signal on break through trendline resistance at 101.98 (bear trendline drawn off 113.02 multi-year high).

The action is supported by improving daily studies as 14-d momentum broke into positive territory and 10/20DMA turned to bullish configuration, along with initial signs of formation of reversal pattern on weekly chart, though with more action required for verification.

In addition, formation of a bear-trap pattern on monthly chart (below 50% retracement of 89.15/114.72 rally) contributes to positive signals.

Bulls eye initial target at 103.04 (daily Kijun-sen), guarding weekly cloud top (103.81) break of which would boost positive signals for stronger recovery.

Weekly close above broken trendline is needed to keep fresh bulls in play.

Res: 102.73; 103.04; 103.58; 103.81

Sup: 101.98; 101.70; 101.36; 100.95