- Gold price ended up closing a volatile week in positive territory.

- The US Dollar lost its strength toward the end of the week despite the Fed’s hawkish stance.

- XAUUSD could extend its recovery in case it confirms $1,675 as support.

Following Monday’s decline, Gold price gained traction and registered strong daily gains on Tuesday. Although the US Federal Reserve’s hawkish tone forced XAUUSD to lose its traction mid-week, the improving market mood and the broad-based US Dollar weakness ahead of the weekend helped the pair stage a rebound and close the week in positive territory. Next week’s Consumer Price Index (CPI) data could help Gold price determine its next short-term direction.

What happened last week?

The negative shift witnessed in the risk mood at the beginning of the week helped the US Dollar (USD) stay resilient against its rivals and caused Gold price to continue to push lower. The disappointing PMI data from China, which showed that business activity contracted in October, caused investors to seek refuge.

On Tuesday, Gold price reversed its direction as US Treasury bond yields declined after the Reserve Bank of Australia’s decision to hike its policy rate by only 25 basis points. In the second half of the day, the data from the United States revealed that JOLTS Job Openings increased to 10.7 million on the last business day of September, compared to the market expectation of 10 million, and helped the US Dollar find its footing. Additionally, the ISM Manufacturing PMI came in at 50.2 in October, surpassing analysts’ forecast of 50. Although Gold price struggled to preserve its bullish momentum during the American trading hours on upbeat United States data, it ended up gaining nearly 1% on the day on Tuesday.

The monthly report published by Automatic Data Processing (ADP) revealed on Wednesday that employment in the US private sector rose by 239,000 in October. This print beat the market projection of 193,000 but failed to provide a boost to the US Dollar with investors staying on the sidelines ahead of the US Federal Reserve’s (Fed) highly-anticipated policy announcements. Meanwhile, Gold price managed to build on Tuesday’s gains and advanced toward $1,660.

As expected, the Fed raised its policy rate by 75 basis points (bps) to the range of 3.75-4% following the November meeting. In its policy statement, the Fed noted that it will take “cumulative tightening, policy lags and economic and financial developments” into account when determining the pace of rate hikes. This comment triggered a risk rally as it hinted at a smaller 50 bps rate increase in December. FOMC Chairman Jerome Powell, however, reaffirmed the Fed’s hawkish stance by noting that he was expecting the terminal rate to be revised higher in December’s Summary of Economic Projections (SEP), the so-called dot plot. Powell explained that it was more important for them to reach the upper limit of the policy rate rather than the size or the speed of rate increases. In turn, US Treasury bond yields gained traction and Gold price made a sharp U-turn, closing the day deep in negative territory below $1,640.

With the positive impact of the Fed’s policy stance on the USD remaining intact on Thursday, XAUUSD slumped to its lowest level since late September and came within a touching distance of the multi-year low set at $1,615 on September 28.

The improving market mood on renewed optimism about China easing coronavirus restrictions provided a boost to Gold price and opened the door for a decisive rebound. The US Dollar struggled to find demand as a safe haven and helped XAUUSD stretch higher toward $1,650 ahead of the October jobs report.

The US Bureau of Labor Statistics reported on Friday that Nonfarm Payrolls rose by 261,000 in October, surpassing the market expectation of 200,000 by a wide margin. Annual wage inflation, as measured by the Average Hourly Earnings, however, declined to 4.7% from 5%. Wall Street’s main indexes opened decisively higher after this report and XAUUSD built on earlier gains to end the week on a firm footing above $1,660.

Next week

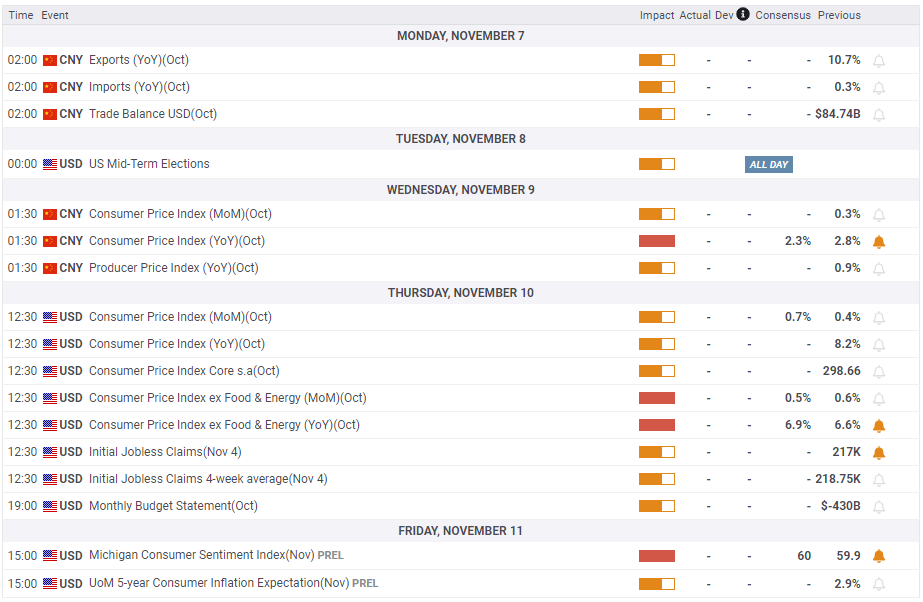

In the absence of high-impact macroeconomic data releases in the first half of the week, market participants will pay close attention to developments surrounding China’s zero-covid policy. In case China decides to soften its stance on re-opening and confirm market rumours, Gold price is likely to gather strength on the back of an improving demand outlook.

On Tuesday, the United States midterm elections will be held but it’s difficult to say what kind of an impact the outcome could have on the US Dollar performance against its rivals or the overall market mood.

The US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data on Thursday. The annual Core CPI is forecast to rise to 6.9% in October from 6.6% in September. A strong inflation print would remind investors of the Federal Reserve’s willingness to stay on an aggressive tightening path and cause Gold price to come under renewed bearish pressure. On the other hand, a softer-than-projected Core CPI reading is likely to allow markets to scale back 75 bps December rate hike bets, providing a boost to XAUUSD in the near term. According to the CME Group FedWatch Tool, markets are still pricing in a 48% probability of a 50 bps rate increase at the last FOMC policy meeting of the year.

On Friday, the United States economic docket will feature the University of Michigan’s Consumer Sentiment Survey for November. Rather than the headline Consumer Confidence Index, markets will pay attention to the 5-year Consumer Inflation Expectations. In October, the long-run inflation component edged higher to 2.9% from 2.7% in September. A straightforward market reaction could be witnessed to this data with a reading at or above 3% weighing on XAUUSD and vice versa.

Gold price technical outlook

The Relative Strength Index (RSI) indicator on the daily chart climbed above 50 and Gold price closed above the 20-day Simple Moving Average (SMA) for the first time in two weeks on Friday, pointing to a bullish shift in the near-term technical outlook.

On the upside, $1,675 (static level, 50-day SMA) aligns as a key pivot level. In case buyers confirm that level as support, additional gains toward $1,700 and $1,720 (Fibonacci 23.6% retracement of the long-term downtrend, 100-day SMA) could be witnessed.

On the downside, the 20-day SMA forms the first support at $1,650 before $1,620 (end-point of downtrend) and $1,600 (psychological level).

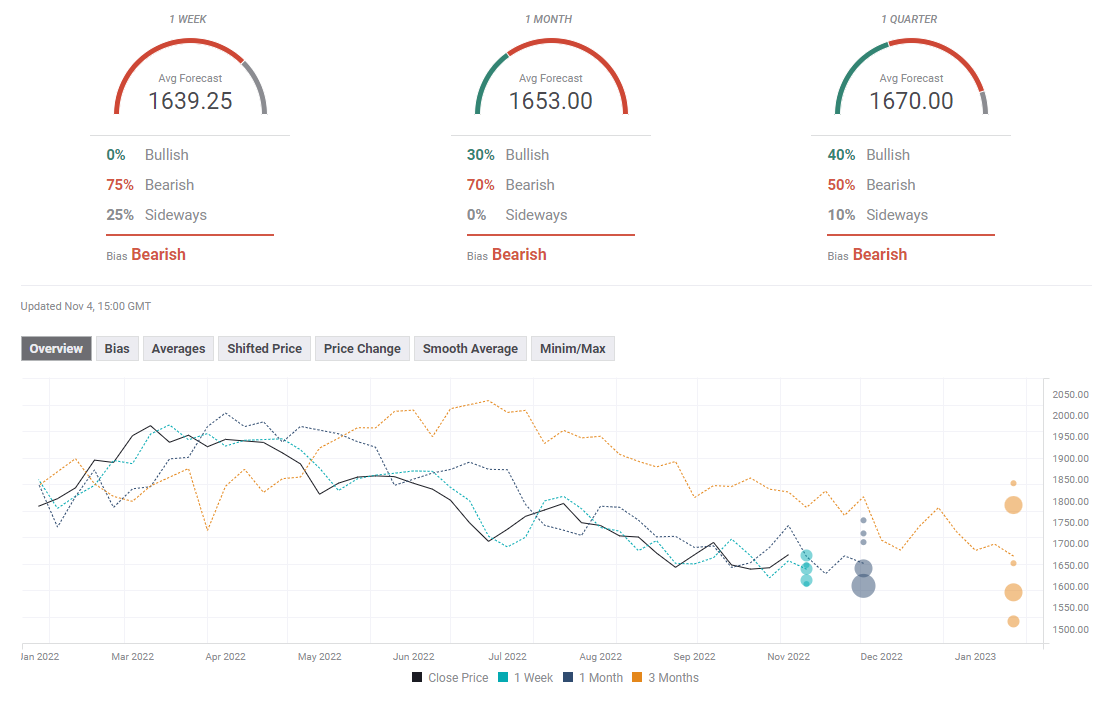

Gold price sentiment poll

Despite Friday’s decisive rebound, experts don’t seem to be convinced about gold price continuing to stretch higher in the near term. The average target on the one-week and one-month outlooks align at $1,639 and $1,653, respectively.