Following yesterday‘s weak rally and bonds showing, S&P 500 bears have the upper hand (timely announcement). Then, the crypto plunge is adding to downswing‘s credibility – about to spill over into tech. Note it didn‘t and doesn‘t take much of a dollar upswing – continuing the rise is enough. Yesterday‘s positive economic data are to be overshadowed by the Fed pronouncements sinking in. Yes, Daly, Kashkari spoke, even mentioning recession uncertainty… And it‘s clear we‘re likely to face quite some tightening ahead, more so than the markets are discounting – and any swift moves in inflation, are faciliated by economic contraction. The bull trap has been set.

Next week won‘t be much better – I‘m looking for grim German PMIs Tuesday, challenged GDP readings on Thursday, and especially the hawkish Jackson Hole. It should be becoming increasingly clear that the risk-on rally is to meet serious reality check, and that lower stock (and other) market data are ahead. The sentiment of my Wednesday‘s recap of deteriorating economy, is to set the tone – and thankfully won‘t be as bad as the German persistently high PPI. Strong dollar to the rescue, a helpful tool in alleviating domestic inflation pressure in the States (yes, U.S. inflation peaked as I was advising you of in advance).

To feel the daily pulse, let‘s move right into the charts – today‘s full scale article features good 6 ones.

S&P 500 and Nasdaq Outlook

S&P 500 bears have the initiative, and Nasdaq is likely to confirm that. Such a setup is where large downswings can be born – not guaranteed today, but quite possible.

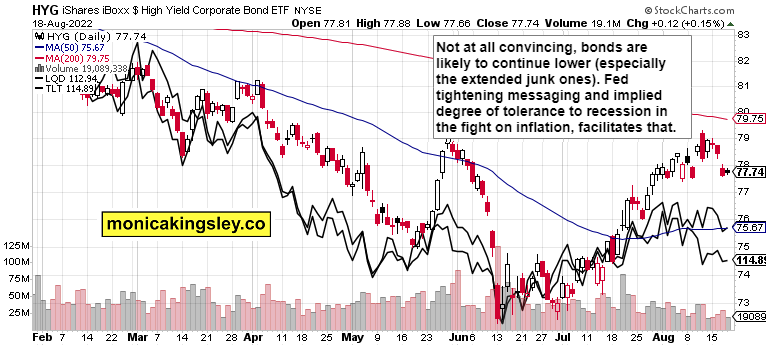

Credit Markets

Fine picture in bonds for the bears – this weak daily pause is likely to give way to lower values. Tightening is putting pressure on inflation trades.

Bitcoin and Ethereum

The crypto break is finally here, presaging more trouble ahead still – putting to rest notions of Ethereum decoupling, at least relatively decoupling. Let the open profits grow!