- The annual Jackson Hole Economic Symposium is scheduled for August 25-27.

- Fed Chair Jerome Powell could use his speech to double down on the hawkish stance.

- US dollar set to rock on Powell’s pivot predictions on policy tightening as inflation rages on.

The US dollar made another attempt to take on the two-decade peak heading into the Jackson Hole Symposium, which is crucial for the market’s pricing of the Fed’s rate hike expectations in the coming months. Will Fed Chair Jerome Powell’s speech provide additional legs to the dollar rally?

Jackson Hole Economic Symposium: Overview

The Federal Reserve Bank (Fed) of Kansas City has been organizing an annual economic policy symposium in Jackson Hole, Wyoming, since 1978. The Kansas City Fed hosts a number of central bankers, academics and economists from all around the world and central bankers have taken the opportunity to direct their monetary policy at this Summit. It’s worth mentioning that in 2020, Powell announced the incorporation of the new average inflation targeting (AIT) framework into the Fed's forecasts.

This year’s event is held from August 25 to August 27, with the main theme centered on “Reassessing Constraints on the Economy and Policy.”

What to expect from Fed Chair Powell?

A week ahead of the much-awaited Fed’s Jackhole Sympoisum, markets repriced expectations of an outsized rate hike as early as next month, triggering an impressive recovery in the US dollar as well as the Treasury yields. Softer US inflation, earlier this month, had doused hopes for a 75 bps September Fed rate hike despite outstanding Nonfarm Payrolls.

With renewed hawkish expectations surrounding the Fed’s tightening path, benchmark 10-year Treasury yields recaptured the 3% level while the US dollar index tested the 19-year high of 109.29 on Tuesday. Powell’s keynote address, scheduled on Friday, is eagerly awaited by traders, as his speech will be closely examined for fresh signals on the policy outlook. Economists widely expected Powell to reiterate that “the Fed’s commitment to controlling inflation will require an extended period of restrictive policy and thus below-potential growth and higher unemployment.”

Also, Powell could use his speech to push back expectations that the world’s most powerful central bank will start easing policy next year. In doing so, the Fed President will likely join the chorus of his colleagues who have recently dampened speculations of the Fed’s pivoting from its hawkish stance, despite mounting recession risks.

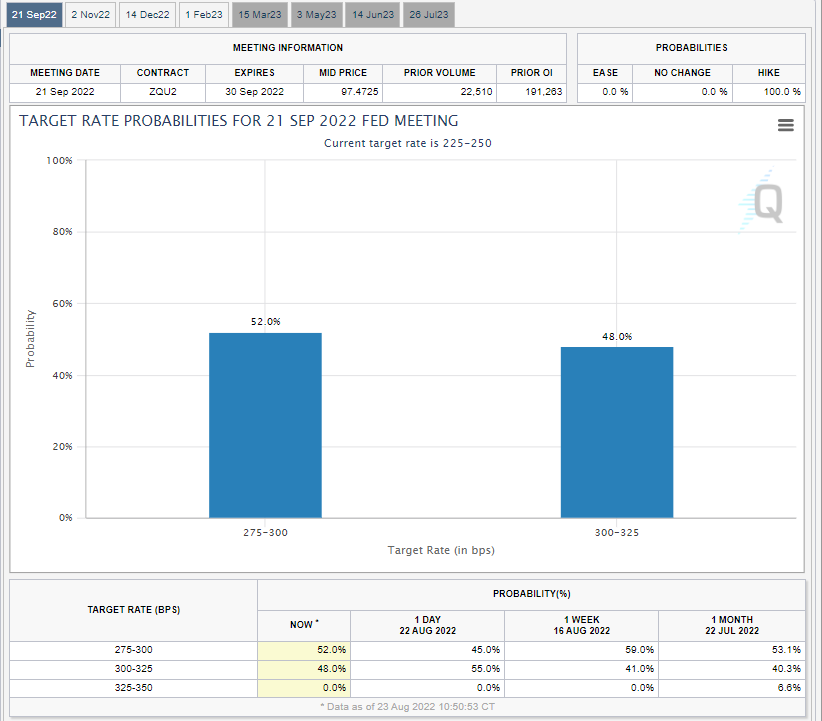

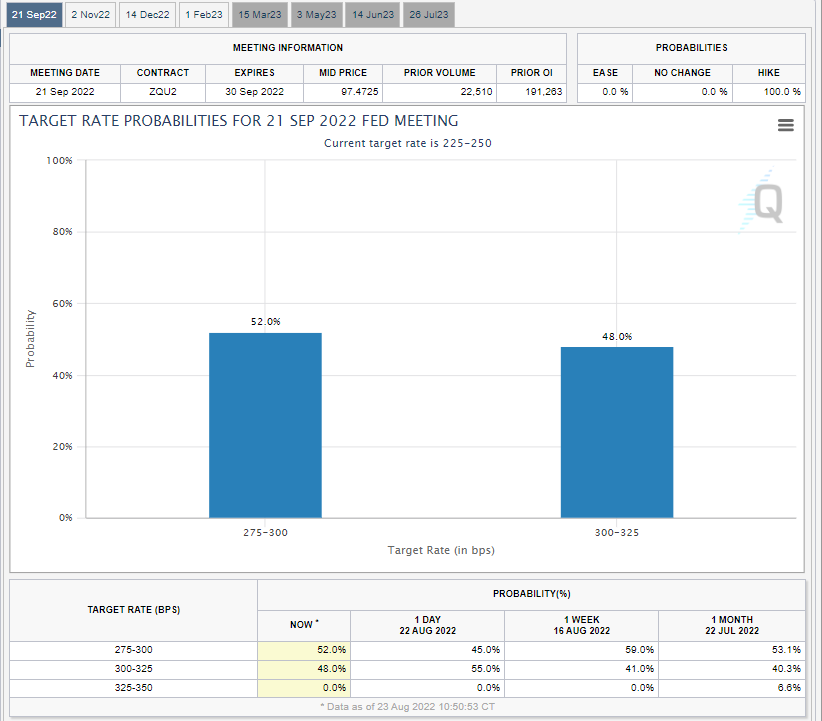

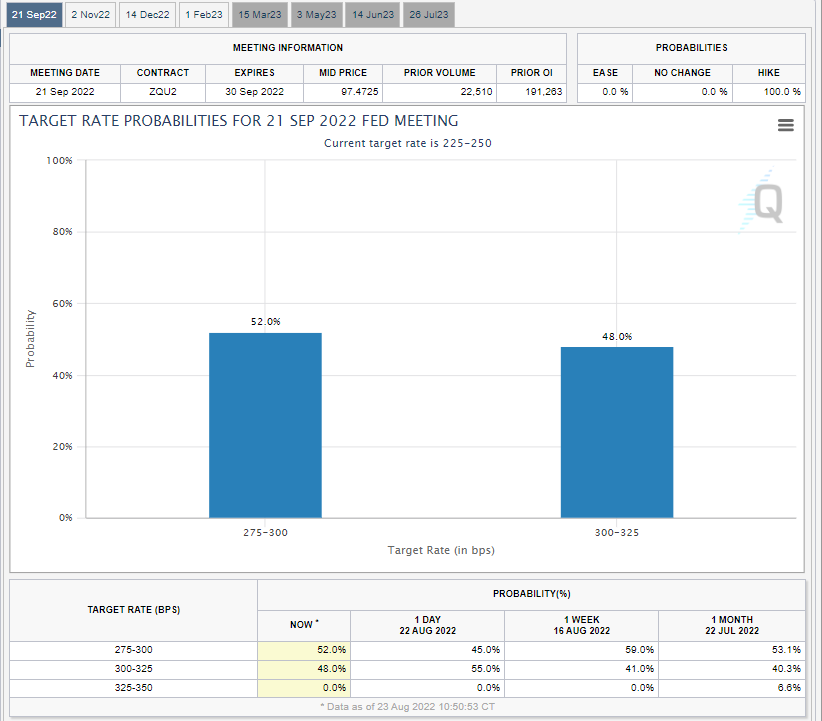

As we progress towards the event, however, the market’s expectations of a potential super-sized rate hike next month are vaporing out, courtesy of the weak US S&P Global business PMI surveys and housing data. The same is being reflected by the CME Group’s FedWatch Tool, which now shows a 48% chance of a 75 bps September Fed rate hike, down from a 55% probability seen a day ago.

Source: CME

Economists at the US banking giants, Goldman Sachs and JP Morgan, now see Powell hinting at pulling the plug on aggressive Fed rate increases. JP Morgan said, “we expect the Fed to become more sensitive to softer activity dataflow now that they have moved policy rates above what was historically considered as neutral. September could be the last of the outsized Fed hikes.”

Meanwhile, Goldman Sachs noted, “He is likely to balance that message by stressing that the FOMC remains committed to bringing inflation down and that upcoming policy decisions will depend on incoming data.”

US dollar index: Technical outlook

At the time of writing, the US dollar is looking to resume its bullish momentum against its main competitors while the 10-year Treasury yields defend the 3% level. The greenback’s fate hinges on Powell’s words, which could turn out to be more hawkish, as suggested by the bullish short-term technical structure on the daily chart.

US dollar index: Daily chart

Following a bullish wedge confirmed on August 15, dollar bulls have been on a roll but capped by the only hurdle at the July 14 high of 109.29. Powell could provide that much-needed push to bulls, which may prompt the buck to record a new 20-year high. The next upside target is aligned at the 109.50 psychological level before the 110.00 threshold could come into play.

The dollar gauge trades well above all the major Daily Moving Averages (DMA) and the 14-day Relative Strength Index (RSI) holds firmer just beneath the overbought region, suggesting that there is more room for the upside.

However, if Powell’s speech signals a slower pace of tightening in the months ahead, then that would be a serious setback to the ongoing dollar. The index could fall back towards Tuesday’s low of 108.06. The last line of defense for buyers is envisioned at 107.29.