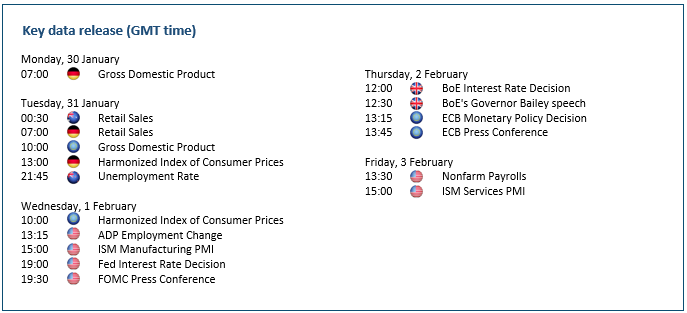

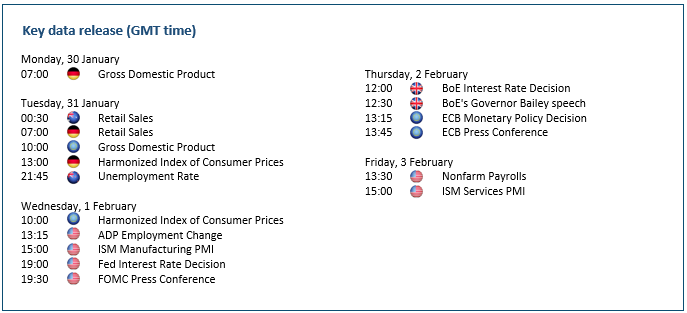

EUR/USD rallies as ECB may remain firm

The euro climbs as the ECB is catching up with its policy normalisation. The central bank is set to raise its key rate by 50 bps this week. The main driver of volatility will be its forward guidance as the debate on the pace of tightening is still open among policymakers. Officials have said that the rate outlook is data dependent, and easing CPI and positive PMI last month could fuel rate hike speculation. The market is currently split between 25 and 50 bps in March, so hawkish statements out of the press conference would prompt participants to price aggressively. The pair is heading towards 1.1180 with 1.0780 as a fresh support.

GBP/USD steadies as BoE to raise by 50bp

The pound retreats as the market repositions ahead of the BoE meeting. The dollar’s broader weakness does not mean that Sterling is in a better shape with UK inflation still in double digits in December. The BoE is expected to lift its rate by 50 bps then another 25 bp in March. What rattles traders is that Britain's economy is more brittle than its US counterpart. Contraction in the latest GDP and PMIs point to a possible recession, though a milder one than previously feared. Looking forward, there is growing concern that higher interest rates could stifle growth. The pair is testing 1.2500 with 1.1900 as the closest support.

XAU/USD rises in hopes of Fed pivot

Gold finds support from hopes of slower interest rate hikes by the Fed. The fact that higher interest rates have not dented investors’ appetite for the non-yielding metal suggests that they may be labelling the restrictive conditions as ‘transitory’. Still, a technical snapback cannot be ruled out given the metal’s ascent lately, the downside risk would be a lack of a dovish undertone. Buyers might be looking for an excuse to take profit, which means that a 25 bp rate hike as expected may actually lead to textbook ‘buy the rumour, sell the news’. April 2022’s high of 1995 is the current ceiling and 1895 a fresh support.

Nasdaq 100 bolstered by robust data

The Nasdaq 100 rallies as recession fears recede amid encouraging economic data. Recent indicators have made investors realise that things are not that bad and a combination of decent growth and easing prices might be the right mix for a soft landing. Despite the Fed’s assertiveness, the fact that other major central banks are talking about pausing their hike cycles definitely helps dissipate some of the pessimism. The market has priced in a smaller increase of 25 bps at the Fed meeting, which has been reflected in more risk-taking in the past few weeks. 12200 is the immediate resistance and 11300 the first support.