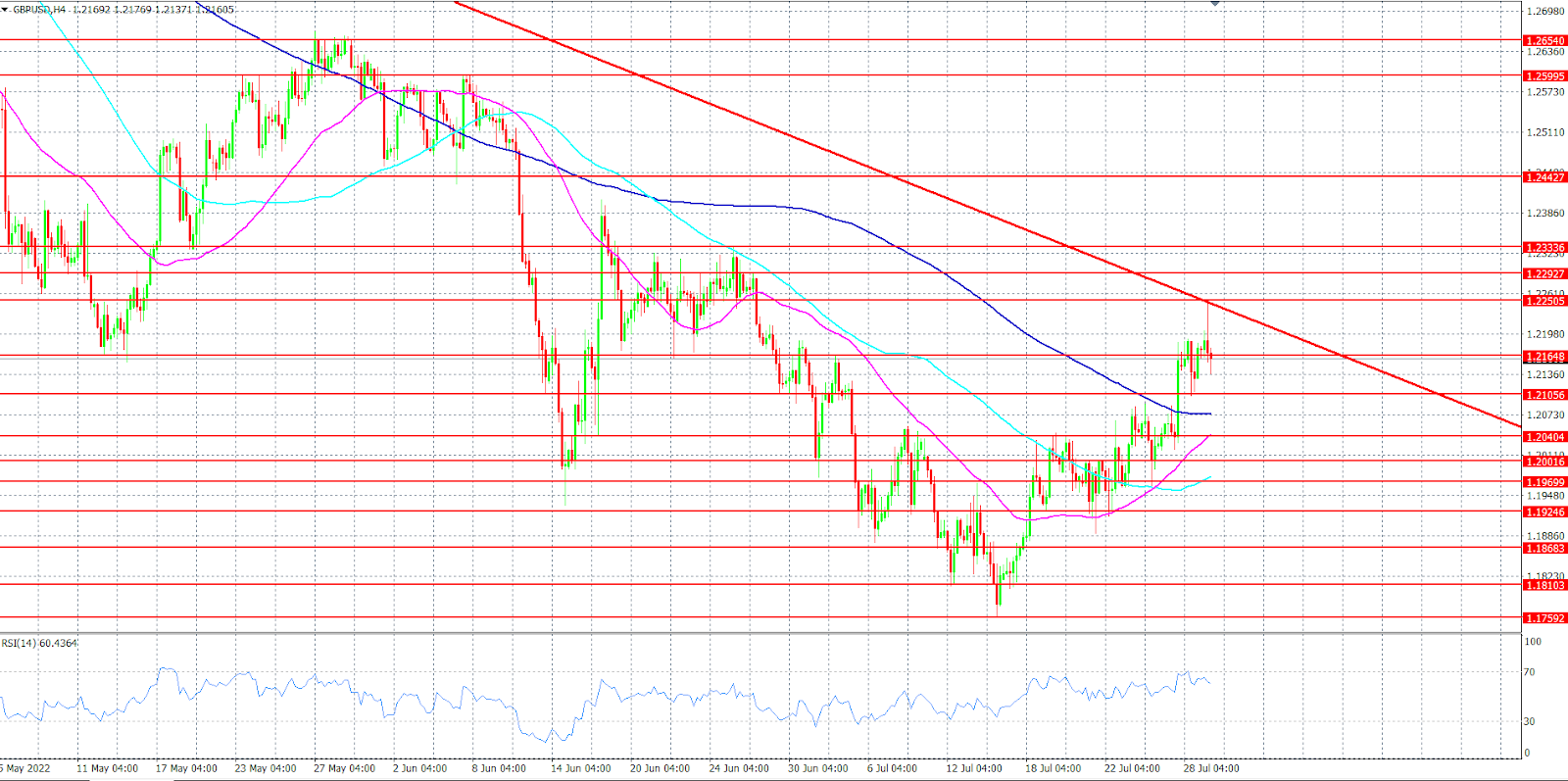

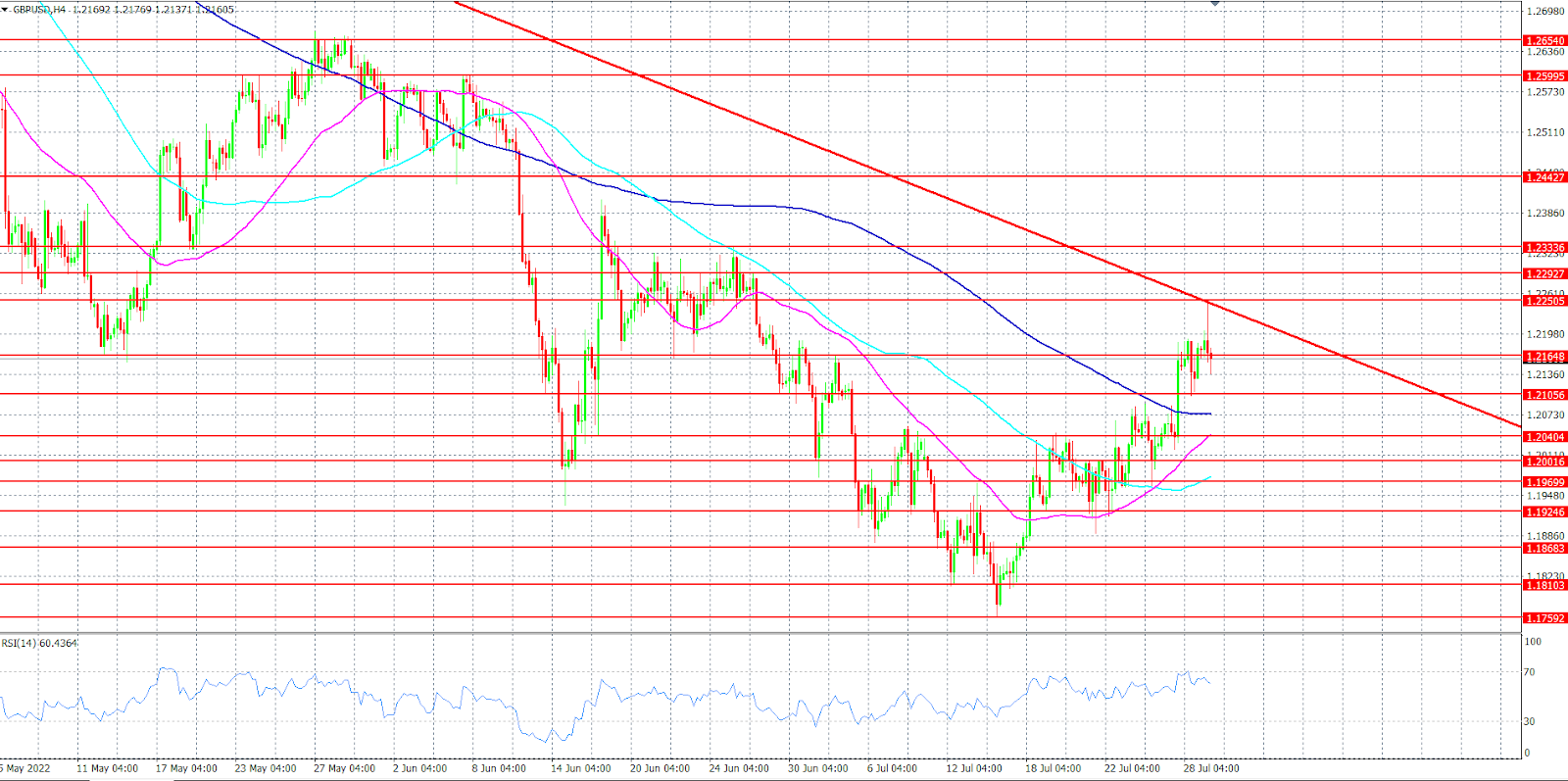

The moving average gives mixed readings in the short term. The readings indicate a more bullish market while the longer term shows the opposite.

The momentum oscillator's relative strength index holds on to the natural zone, recording a 62 on the value line. Any uptick would support the bull market's continuous

The British pound edged lower today in the initial European session after hitting the day's high, which coincided with the descending trendline at 1.2250. At press time, GBP/USD was trading at $1.2162, down -0.0016 or 0.13% on an intraday basis.

The GBP/USD rose by approximately 500 pips from the year’s low that occurred on July 14. However, the cable has reached a level where the descending trendline acts as a guard, preventing the price from continuing its bullish trend. As a result, cable has retreated by around 100pips after hitting the descending trendline.

This analysis relies on a four-hour time frame

On the four-hour timeframe, the moving average reading shows mixed indications. The reading indicates the bullish continuation in the short-term support. The 50-MA crosses over above the 100-MA. Meanwhile, for a longer read of the 100-MA crossing below the 200-MA which does not support the bullish trend. However, the Relative Strength Index holds in the neutral zone, recording 62 on the value line. Any uptick would encourage the cable to encounter the descending trendline again.

The GBP/USD has been highly volatile on the previous two trading days, which makes a fake breach more likely to occur today. However, if the pound wants to continue its bullish trend, it should breach the first resistance level at 1.2164. A successful breach of the mentioned level would pave the way towards today’s high, which coincides with the descending trendline near the 1.2250 level. If the price could close the 4-hour candlestick above the descending trendline, this may bring the 1.2292 resistance level into the eyes of market participants, followed by the 1.2333 resistance level, which was last seen on June 28.

Alternatively, if the resistance level of 1.2164 could prevent the price from gathering more gains, that may push the price towards the support level of 1.2105. A successful breach of the previously mentioned level would allow the price to retest the 1.2040 support level. Crossing down below that level would bring the support level to 1.2001, followed by the support level of 1.1969.

Note: That when a resistance level is broken, it becomes a support level since the price will trade above it, and vice versa. Alternatively, the market may perform a false breakout or rebound after breaking support, or vice versa. Additionally, the market could bounce from any level of support or decline after breaking any level of resistance.