Outlook: This week in the US it’s mostly housing data, consumer confidence and a biggie, personal income and spending on Friday–but Friday is the day before Christmas and almost certainly a short day in Europe and the US. Elsewhere the new include inflation and BoJ meeting in Japan. The IFO and Gfk indices in Germany, and a ton of data from Canada, including CPI and retail sales.

Canada will see a run of important releases headlined by consumer prices on Wednesday, where favorable results are the expectations, preceded by what is expected to be a strong rebound for retail sales on Tuesday and no change for monthly GDP on Friday. Two things count the most: the policy response to the Covid surge in China and US inflation. We have a boatload of opinion pieces on the Chine Covid surge situation. We take the view that China knew it would get a surge of cases and deaths of about a million, as described above, and lifted restrictions anyway. This decision was not to show the protesters what the government was protecting them from, but rather an economic decision. Harsh quarantines and city lockdowns were costing too much economically and lifting unemployment in the critical 17-20 year old demographic. Growth forecasts were down around 3.5%. A good third of the expected deaths are expected in the seriously old population that is not the workforce, anyway. Bottom line: China re-opening means good news for two critical areas–inflation will fall on increased supply and rising commodity prices.

The market is still not buying the Fed’s resolute stance on rates higher for longer. The Fed foresees the Fed funds rate over 5% next year and for most of all of the year. But futures say otherwise–the implied terminal rate for May remains at 4.83%, with almost a half point of rate cuts still priced between then and the end of 2023.

Good news on inflation, maybe–the New York Fed on Friday released its “underlying inflation gauge,” which is NOT core but rather its own alternative to the CPI. For definitions, If you like to get this stuff yourself, you can sign up for the NY Fed’s “email alerts.”

Remember, CPI was 7.1%. The NY Fed underlying inflation (“full data set”) gets 4.1%, down 0.2%. The “prices-only” measure is 5.6%, down 0.1%. Here’s a juicy statement: The mean “trend CPI” is within a range of 4.1% to 5.6%, a slightly wider range than October. See the chart.

The thoughtful Authers at Bloomberg writes “A growing majority of observers think inflation is at last at the point where it will come down without too much more help from monetary policy. Evidence that inflation expectations remain fairly well-anchored bolsters this thesis, as does the belief that commodity prices will continue to fall and that supply chain problems are more or less over. With central banks committed to quantitative tightening (selling bonds from their portfolios into the market), as well as keeping rates high, the argument is that inflation will be under 3% by the end of next summer. Such a scenario plainly motivates a majority of the managers controlling large funds at present. A “pain trade” would thus involve rising bond yields and rising risk assets as the economy continued to stay buoyant.”

The mysterious job market in the US is the biggest roadblock to the recession scenario. One pushback to the conventional idea of job growth comes from the Philadelphia Fed’s Early Benchmark Revisions of State Employment Data. The Philly Fed says employment is being seriously overstated by official statistics. In Q2, “In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states; the U.S. Current Employment Statistics estimated net growth of 1,047,000 jobs for the period.” In other words, employment is overstated by a vast amount–only 10,000 instead of over a million. Authers says “If employment has been overstated this seriously, then the bears may well be right, and further Fed tightening would be very dangerous. Expect this to be a critical issue for the next few months.”

Then there is the conventional wisdom that it takes a super0long time for inflation to be tamed. This is “illustrated in the following chart from History Lessons: How “Transitory” Is Inflation? by Rob Arnott and Omid Shakernia of Research Associates LLC.”

The chart is hard to read. It says, basically, it can take well over a decade to get inflation down from 8% to 3%. Ah, but we say this is based on past inflation periods driven by excessive demand. This time inflation was driven by supply shortages. Can we use that old experience? Still, it’s haunting that “on the basis of post-1970 history, the notion that inflation having topped 8% will get back to 3% in barely 12 months looks far-fetched.”

Let’s make some assumptions, first that the NY Fed underlying inflation gauge has validity and inflation is indeed falling nicely. Maybe 3% next year is too much to hope for, but perhaps 3.5%-4.25% is possible. In that instance, it would not be Fed chickening out but rather displaying data dependency, as it likes to claim. Maybe the futures market is right that we won’t get a terminal rate next year at 5% and over, but rather a max of 4.83% (and presumably falling).

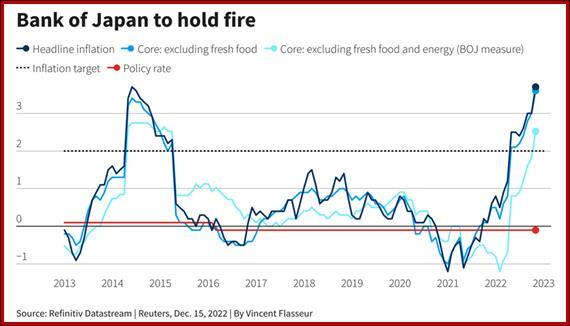

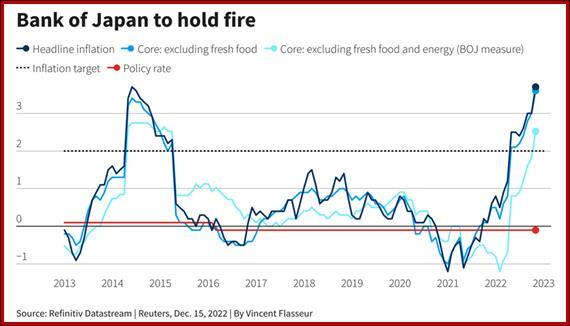

If this plays out, all those professionals stuffing their books with bonds will be crying in their beer. And the dollar’s softness will be vindicated and will persist. An interesting side note to the global picture is whether Japan is going to drop its curve control policy and hike rates. The yen being so well big seems to suggest some traders are buying this story. And check of that chart. So, in the end, it’s the expectation of change that drive FX rates, with only an eye on the current differential.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!