- Annual CPI in the US is forecast to decline to 6.5% in December.

- Markets remain optimistic about a policy pivot despite hawkish Fed commentary.

- EUR/USD and USD/JPY are likely to react significantly to inflation data.

The US Dollar Index has been moving in a downtrend since early October with investors anticipating a less aggressive policy tightening by the Fed in light of soft inflation readings. On Thursday, January 12, the US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data for December.

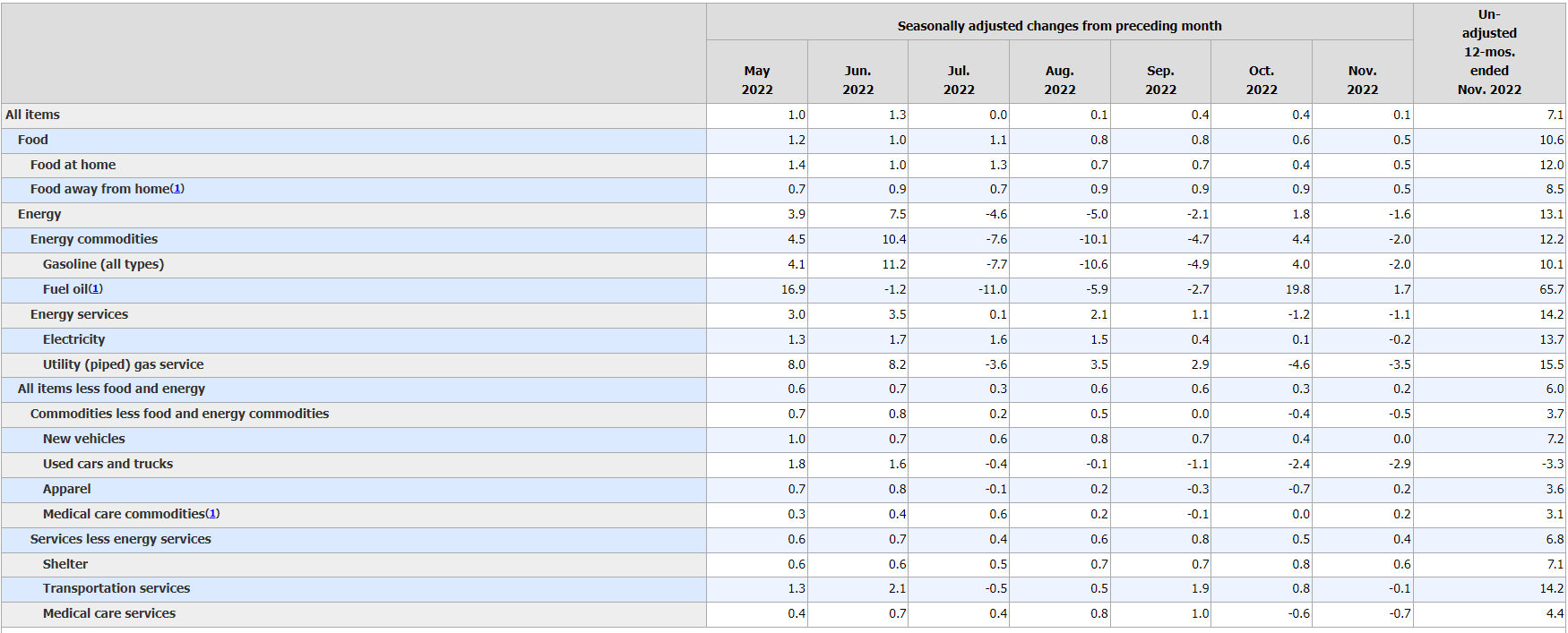

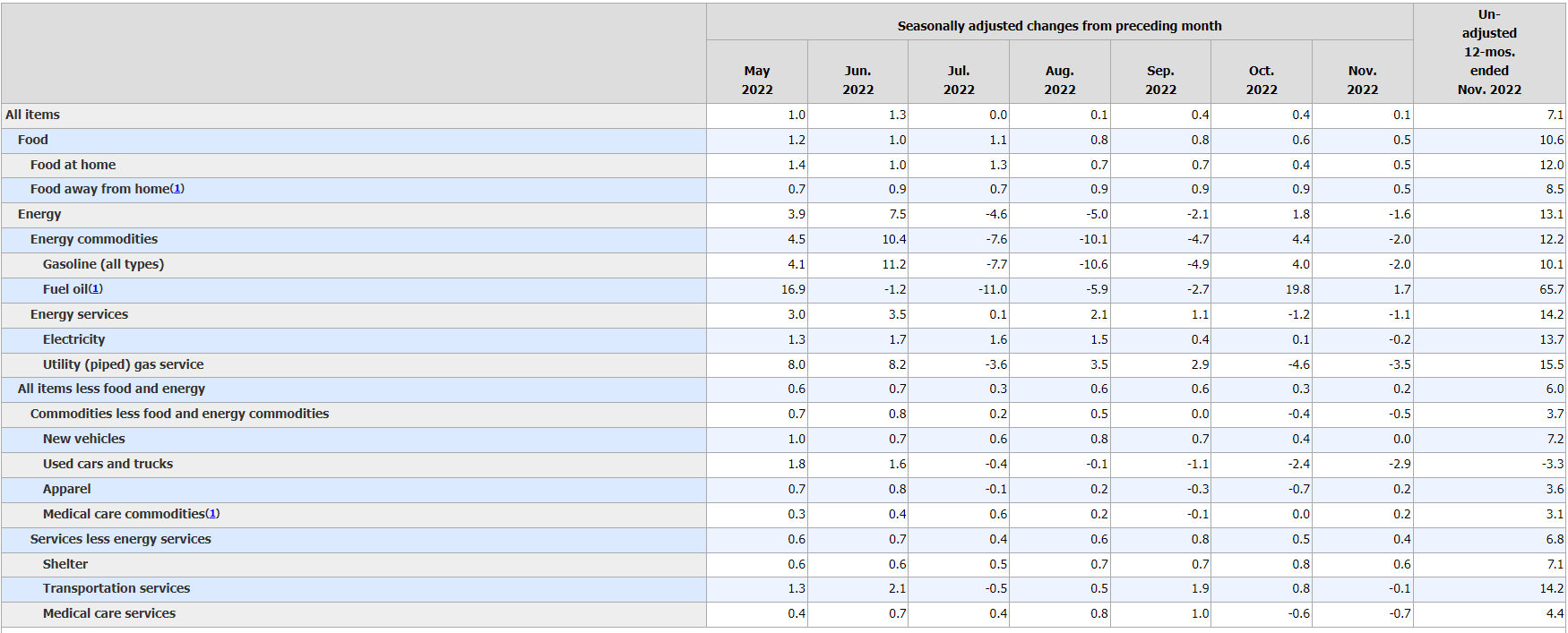

Investors expect the annual CPI to decline to 6.5% from 7.1% in November and see the Core CPI, which excludes volatile food and energy prices, edging lower to 5.7% from 6%. On a monthly basis, the CPI is forecast to stay unchanged while the Core CPI is projected to rise 0.3%.

Following the December policy meeting, the US Federal Reserve’s revised Summary of Projections (SEP) showed that policymakers’ median view of the policy rate at end-2023 rose to 5.1% from 4.6% in September’s SEP. Currently, the CME Group FedWatch Tool shows that markets are pricing in a nearly 80% probability of the Fed raising its policy rate by 25 basis points to the range of 4.5-4.75% in February.

Although Fed policymakers have been pushing back against the market expectation for a policy pivot in late 2023, the recent action in the US Treasury bond yields and the US Dollar Index suggests that investors are not convinced. The yield on the benchmark 10-year US Treasury bond is already down nearly 8% in January.

Market implications

The initial market reaction to inflation figures should be straightforward with a smaller-than-expected increase in monthly Core CPI weighing on the US Dollar and vice versa. Underlying details of the report will help investors figure out whether the impact on the US Dollar can be long-lasting.

While responding to questions at the post-meeting press conference in December, FOMC Chairman Jerome Powell noted that they will be keeping a close eye on non-housing core services inflation moving forward. Hence, the “Services less energy services” item of the CPI will be key, which rose 0.4% in November and stood at 6.8% on a yearly basis. In case the monthly Core CPI comes in lower than expected but this component rises at a strengthening pace, the US Dollar’s losses could remain limited following the immediate reaction.

On the flip side, a hot Core CPI reading combined with a strong increase in the “Services less energy services” item should cause investors to reassess the possibility of a Fed policy pivot and trigger a steady recovery in the US Dollar.

Assets to watch

If the US Dollar sell-off picks up steam after the inflation report, USD/JPY and EUR/USD pairs are likely to offer better trading opportunities than GBP/USD. The European Central Bank adopted a surprisingly hawkish stance after the December meeting and markets anticipate the Bank of Japan (BoJ) to take a tightening step following its decision to tweak the yield curve control strategy heading into 2023. On the other hand, the Bank of England made it clear that it’s nearing the end of its tightening cycle.

Market participants will also keep a close eye on Gold price. XAU/USD benefited from retreating US T-bond yield and started the new year on a firm footing. A strong rebound in yields could weigh heavily on the inversely-correlated pair. In case the 10-year US T-bond yield drops below 3.5% after the data, Gold price could target new multi-month highs near $1,900.