- ISM will release the July Services PMI report on Wednesday, August 3.

- Markets have been scaling down hawkish Fed bets since the last FOMC meeting.

- Inflation component of the PMI survey could impact the dollar's valuation.

The dollar has been having a difficult time finding demand amid disappointing macroeconomic data releases and the Fed’s decision to abandon rate guidance. The US Bureau of Economic Analysis’ initial estimate showed that the US economy contracted at an annualized rate of 0.9% in the second quarter and the probability of a 75 basis points (bps) Fed rate hike in September dropped below 20%.

On Monday, the Institute for Supply Management (ISM) reported that the business activity in the manufacturing sector continued to expand at a moderate pace with the headline Manufacturing PMI coming in at 52.8. The Prices Paid component of the survey, however, declined to 60 from 78.5 in June, revealing a remarkable easing in price pressures. Consequently, the US Dollar Index (DXY), which tracks the greenback’s performance against a basket of six major currencies, fell to its lowest level in a month near 105.00.

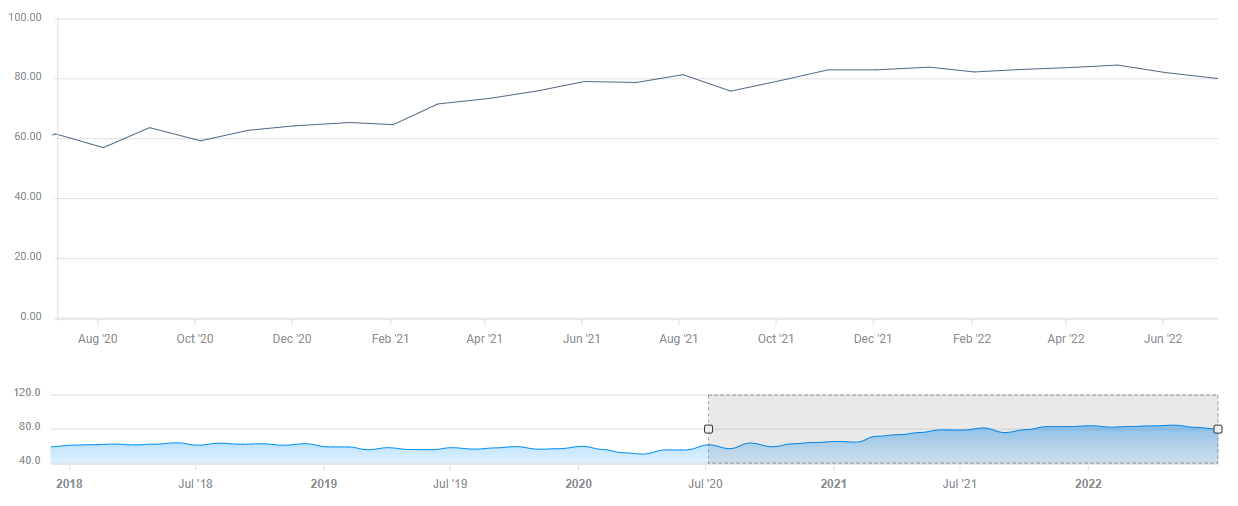

DXY daily chart

Dollar bears look for signs of softening inflation

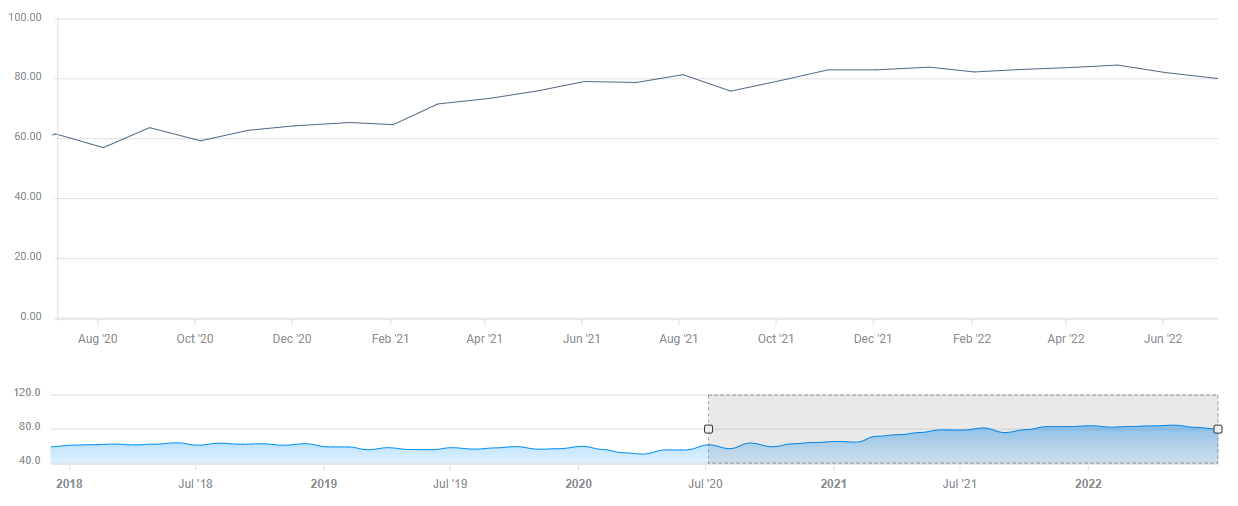

On Wednesday, the ISM will release its Services Report on Business. The headline PMI is forecast to edge lower to 53.5 in July from 55.3 in June while the Prices Paid component is expected to rise to 81.6 from 80.1.

Market participants are likely to react to inflation developments rather than the overall state of the service sector unless the headline PMI diverges from the market consensus in a significant way. A Services PMI reading below 50 should escalate inflation fears and cause markets to continue to scale down hawkish bets. On the other hand, an unexpected jump could open the door for a USD rebound but such a reaction should remain short-lived.

In case the report unveils a noticeable decline in the Prices Paid component, the dollar could continue to weaken against its peers. According to the CME Group’s FedWatch Tool, markets are pricing in an 81.5% chance of a 50 bps rate hike in September, suggesting that there is more room on the downside for DXY if the data is seen as a factor that would allow the Fed to remain cautious with regards to future rate increases. On the contrary, investors could refrain from betting on further dollar weakness if the Prices Paid component remains elevated above 80.

ISM Services PMI, Prices Paid Index

Markets should pay close attention to the Employment component as well. Ahead of Friday’s jobs report, a print below 50 would point to a contraction in the service sector employment and put additional weight on the USD’s shoulders.

To summarize, the only dollar-positive scenario would be with the ISM’s publication revealing that inflation continued to run hot in the service sector in July.