Another pivotal week lies ahead for currency traders, with the latest US inflation report set to decide whether the dollar’s relentless rally will finally cool off. Meanwhile, markets are leaning towards a half-point rate increase from the Bank of England, although sterling’s fate is mostly in the hands of global forces.

Inflation cooldown

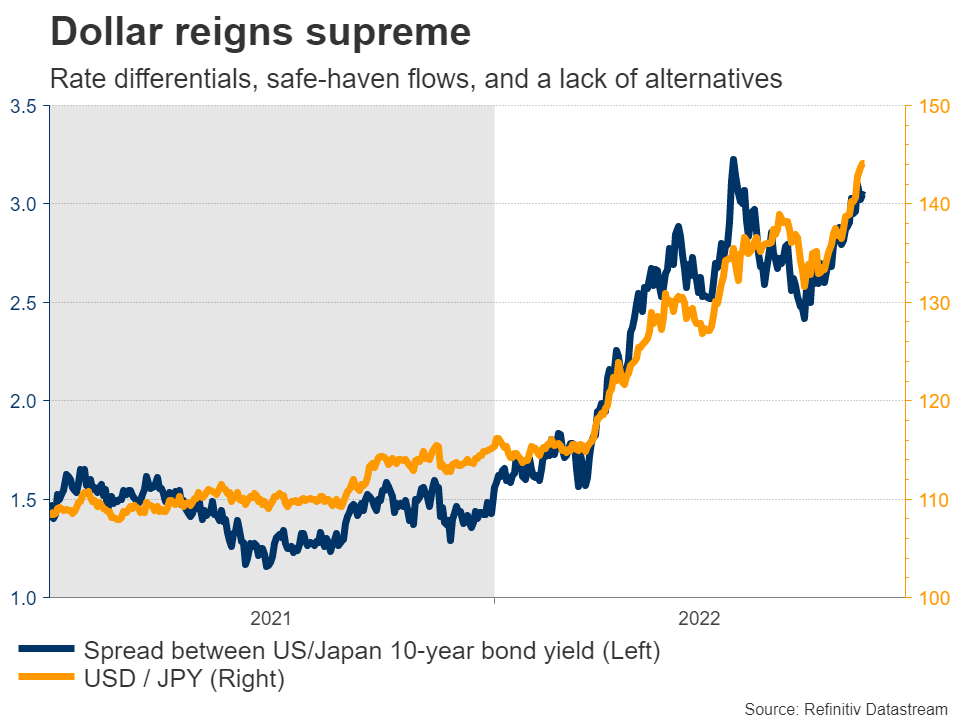

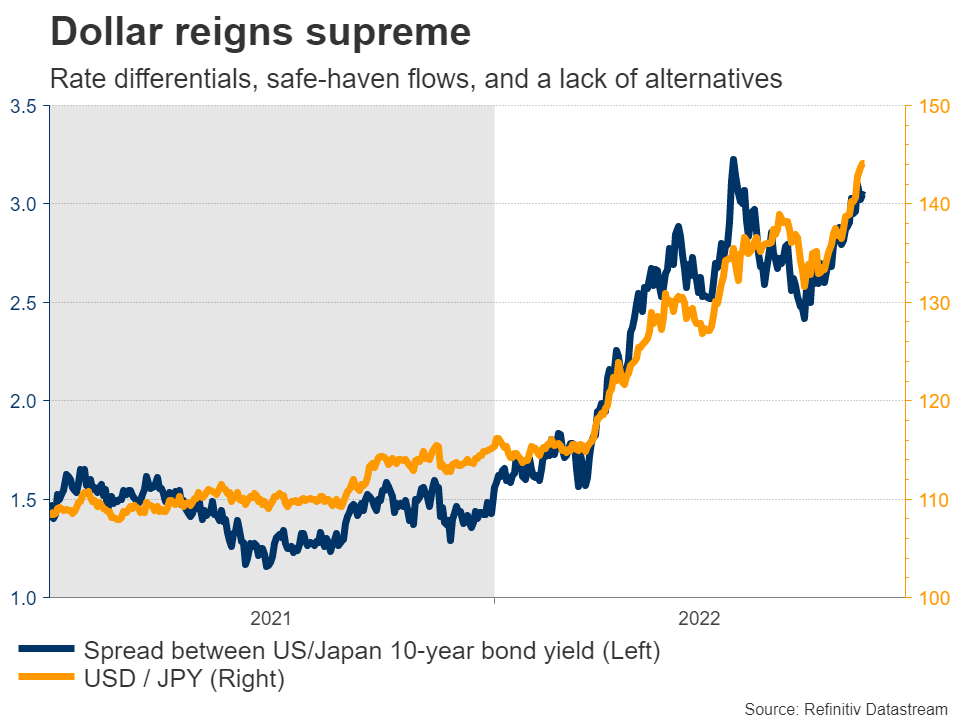

It’s been a glorious year for the US dollar so far. The reserve currency is essentially the only asset that has gained ground over the last nine months, riding a perfect wave of widening interest rate differentials, safe-haven flows, and an absence of alternatives.

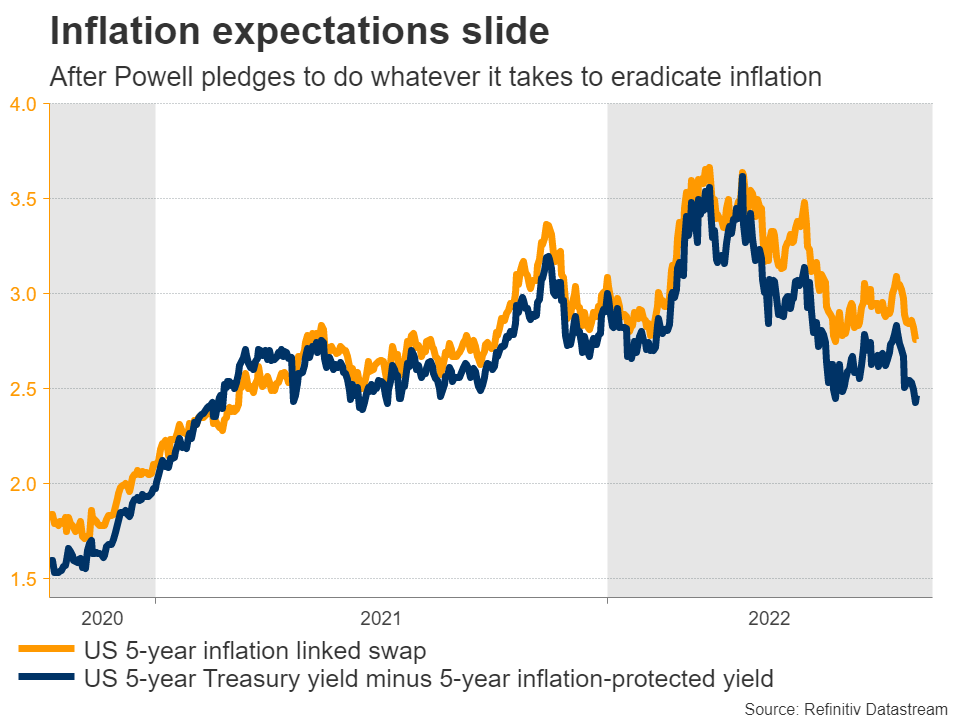

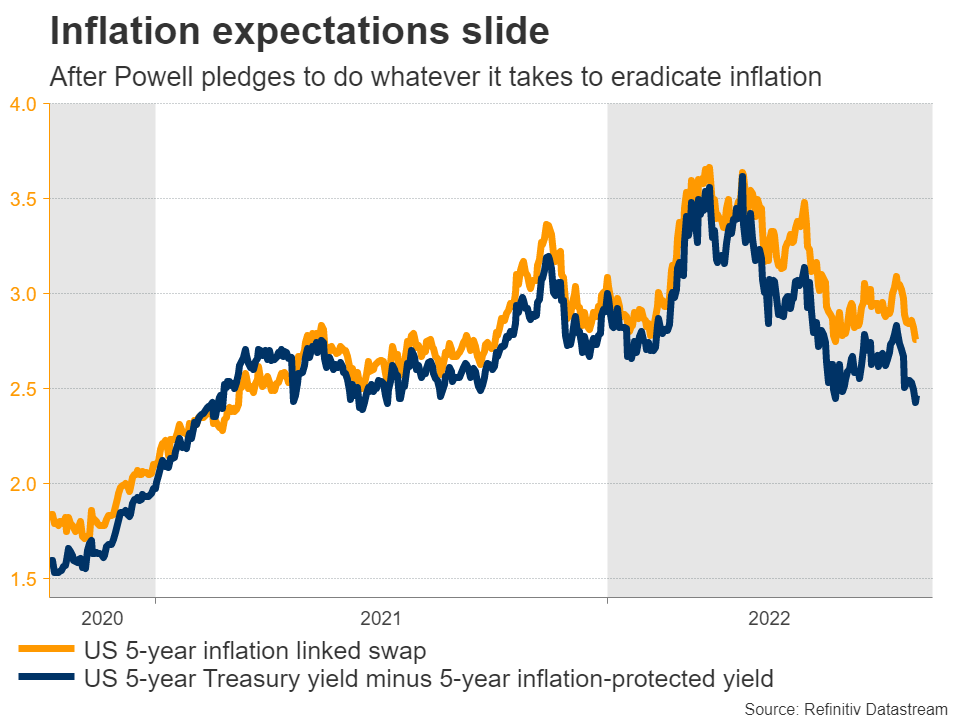

The Fed poured gasoline on this rally recently when Chairman Powell pledged to do whatever it takes to eradicate inflation, even if that means a period of economic pain. He reinforced the notion that interest rates will need to be kept high for some time, sending traders scrambling to price in a ‘higher for longer’ path.

Encouraged by a labor market that is essentially at full employment, the Fed chief is convinced the economy can absorb this blow without sliding into a deep recession. Markets are currently pricing in an 85% probability for another three-quarter point increase this month and a terminal rate of just under 4% to be reached early next year.

Naturally, the upcoming data will be a crucial piece of this puzzle. The CPI inflation report for August is out on Tuesday and forecasts point to a negative monthly print, which would drag the yearly rate down too. Gasoline prices kept sliding during the month and business surveys from S&P Global suggest services companies raised their selling prices at the slowest pace in one-and-a-half years, adding credence to the forecast.

A second consecutive month of softening price pressures would be music to the ears of Fed officials, but it wouldn’t be enough to get them off their warpath. The Fed’s second-in-command, Lael Brainard, said this week it would take “several” months of low inflation readings before they become confident inflation is moving down to its 2% target.

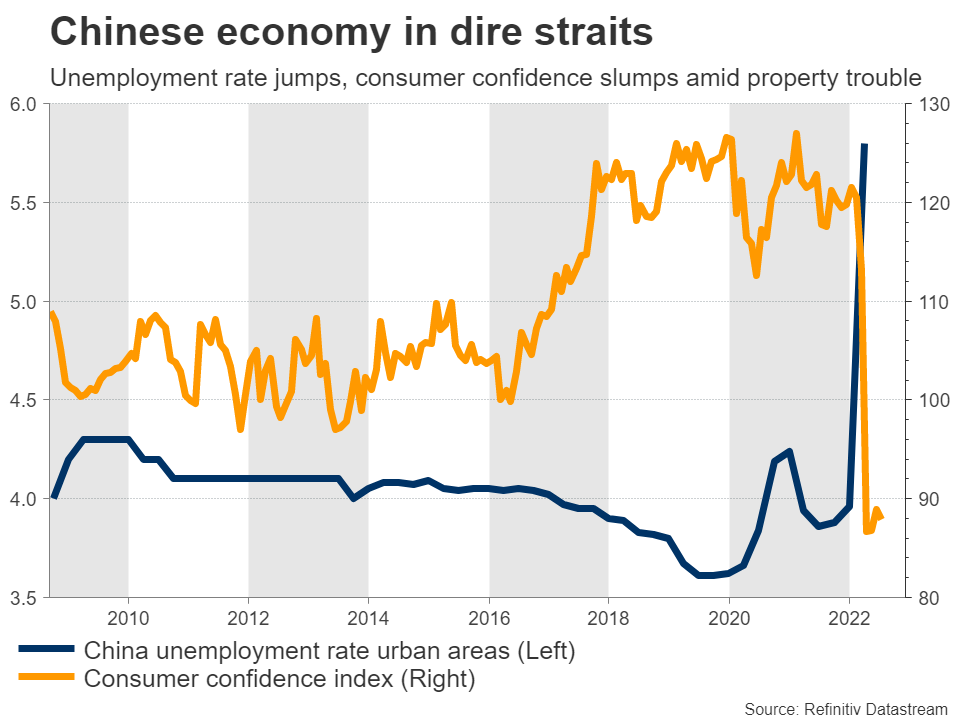

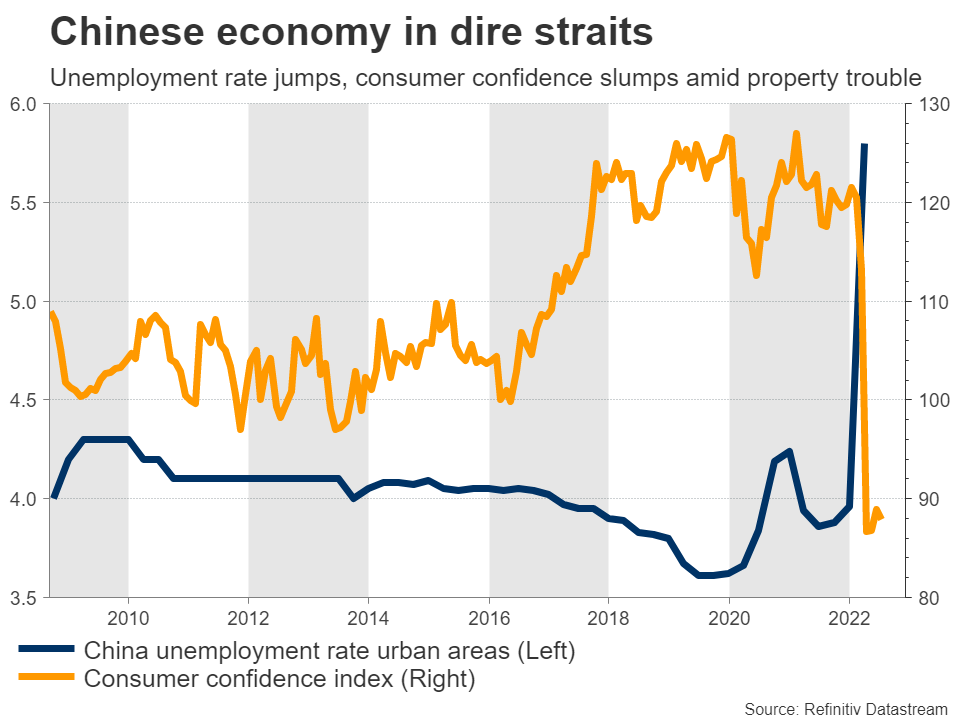

As for the dollar, even a disappointing inflation print is unlikely to change the overall trend. The markets could start flirting with a half-point Fed hike this month and that might deal a blow to the greenback, but it is difficult to envision a reversal while Europe is suffering from energy shortages, the yen is in freefall, and China’s property crisis is deepening.

Retail sales for August will follow on Thursday, ahead of the latest University of Michigan consumer survey on Friday, which has turned into a market-moving release lately.

BoE – double or triple?

Over in the United Kingdom, the Bank of England will announce its rate decision on Thursday. Market pricing is leaning towards a half-point rate increase, assigning a 65% probability to this scenario against a 35% chance for a larger move of three-quarters of a percent.

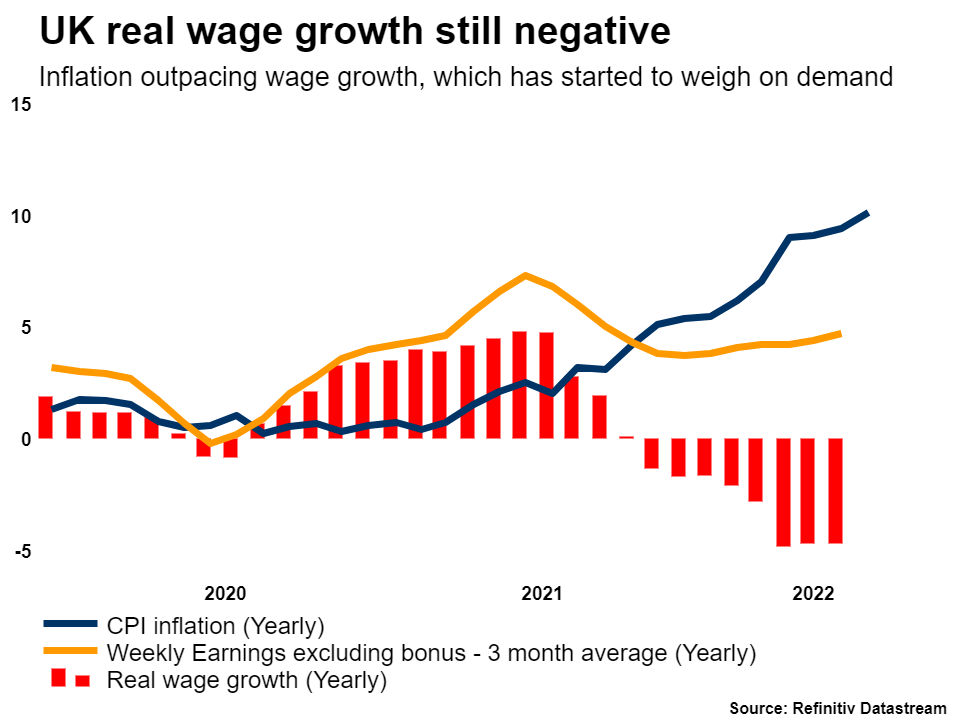

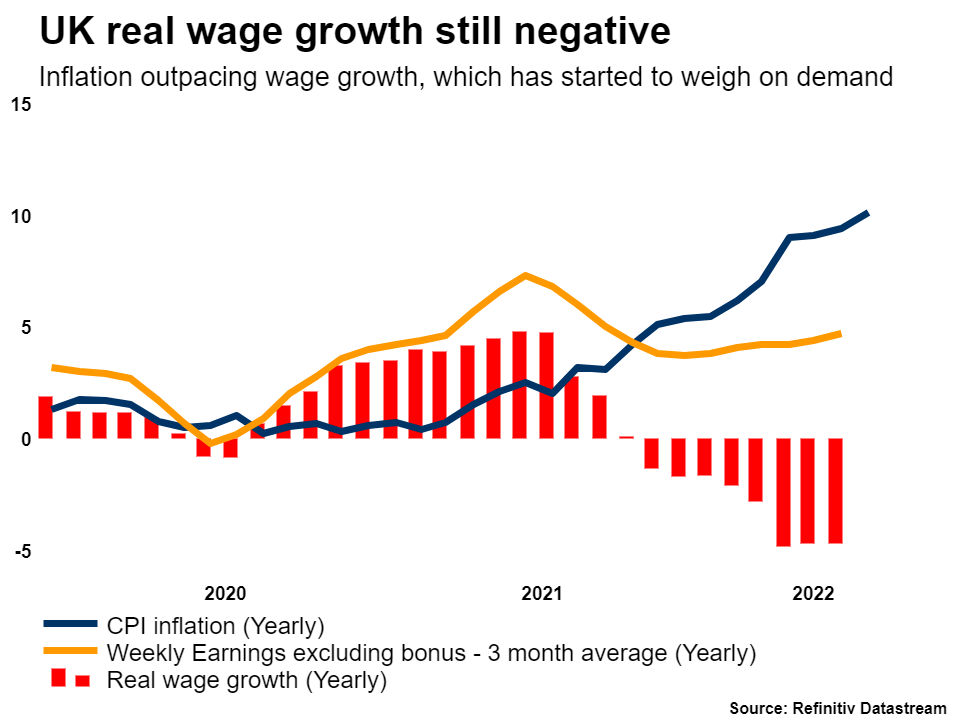

It’s a tough choice for the BoE. Business surveys point to an economy that's already contracting as demand crumbles under the weight of the cost-of-living crisis. Along with the government’s plan to cap energy prices, which will likely prevent inflation from reaching the 13% peak the BoE envisioned in its latest forecasts, there is a strong case that policymakers should play it safe and opt for the smaller move.

The problem with that is the exchange rate. Sterling has already depreciated dramatically, second only to the collapsing Japanese yen this year. Going for half measures would invite further weakness, exacerbating inflationary pressures.

There’s a barrage of data releases ahead of the rate decision that will help shape market expectations. The show will kick off on Monday with GDP stats for July, ahead of the employment report for the same month on Tuesday, and the latest inflation data on Wednesday. Then on Friday, retail sales for August are due out.

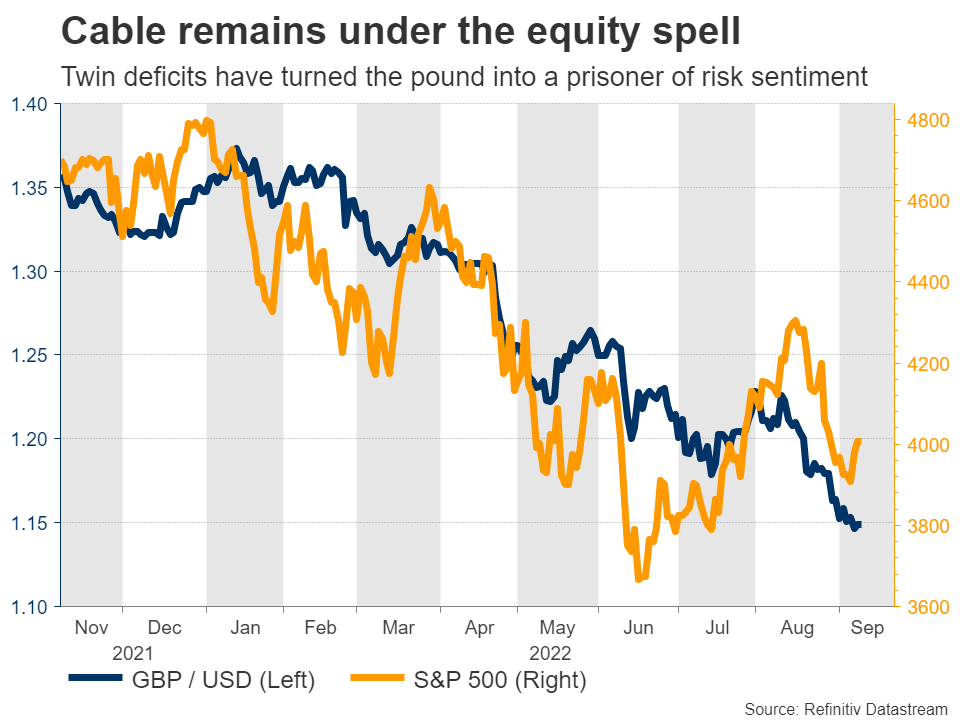

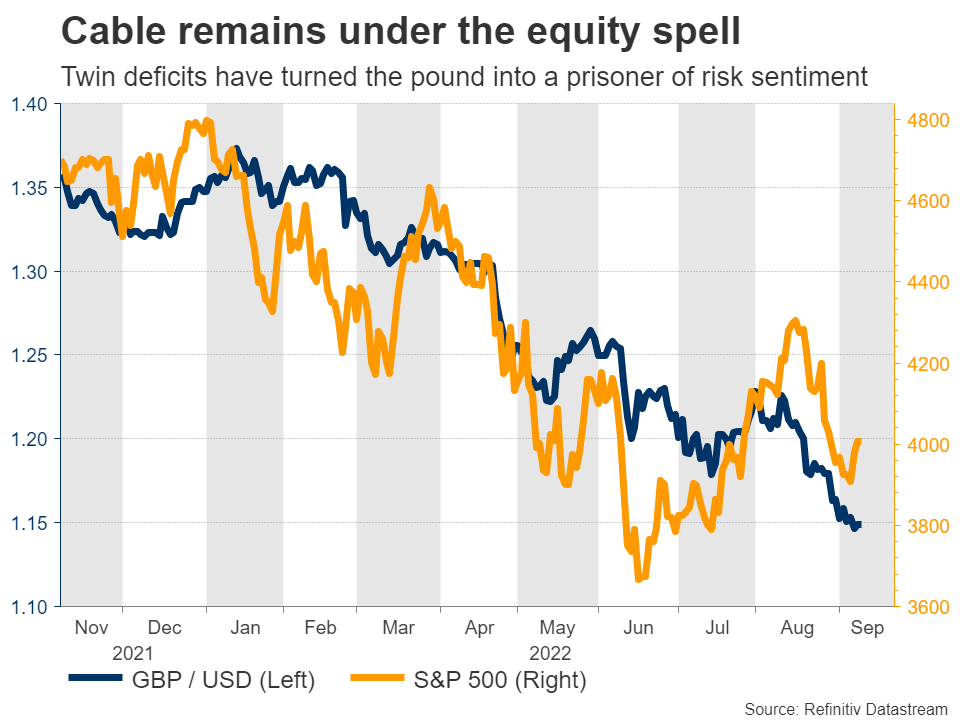

As for sterling, the most important variable won’t be how hard the BoE strikes next week but rather what happens with stock markets. Because of the UK’s chronic twin deficits, the pound has developed a tremendous sensitivity to global risk sentiment, with Cable trading in lockstep with the S&P 500 most of the time.

In this respect, the outlook for stocks remains challenging. The Fed is hell-bent on keeping rates high until inflation is vanquished, the pace of quantitative tightening doubled up last week, valuations are still not cheap, and a series of earnings downgrades might be imminent if Europe and China continue to roll over.

A glance at China

Finally, the monthly data dump from China that includes retail sales and industrial production will be released on Friday. Investors will pay close attention to assess the damage from a property sector in freefall and the recent lockdowns of major cities.

Ahead of this dataset, Australia’s latest jobs numbers and New Zealand’s GDP print for Q2 will hit the markets on Thursday. Although both of these economies are solid domestically, it is difficult to be optimistic on their currencies considering their high exposure to China.

With the Chinese economy struggling, demand for the raw materials that Australia and New Zealand export will inevitably take a sharp hit, which paints a gloomy picture for growth.